MD/CEO Polls & Ratings Limited

E-mail: prlresearch@consultant.com

“If you don’t know where you are going, you’ll end up somewhere else”, so said a famous American football coach, Casey Stengel. This is what happens with a faulty planning – in fact it could be worse than no planning at all, because executives think they are making sound decisions, unaware that they are operating on a basis of ignorance and myth. This is reflected in traditional concepts that they adopt in marketing and management, usually in a dizzying frenzy and with unmatched exuberance, as if trying to catch up with a trend that is threatening extinction.

Take the issue of understanding the operating environment – the socio-cultural question. Not many business operatives ever take the pain to conduct pre-launch programmes before releasing their products into the market. Examples abound in the financial services industry. The reasons for this are not far-fetched: most marketing managers are not well trained for their profession and so what one finds in that sector are dozens of unmarketable products, which end up doting shelves and covered with heaps of dust because they can’t be sold. At other times, the products die, and then the company will spend a fat chunk of its marketing budget to revive them through some promotional tonic.

In most cases, consumer response is like engaging deaf people in a conversation. Yet still, some die taking sums expended on them into early graves. The other reason is that in their drive to outdo the competition most businesses do not go the extra mile to conduct baseline studies that will reveal consumer preferences. Also, their marketing or advertising agencies do not help matters.

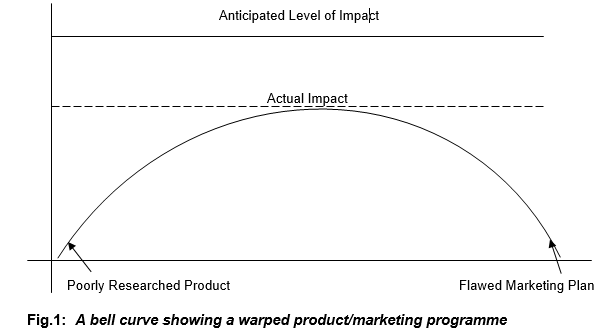

Since most companies are wary of a padded marketing budgets (expensive briefs), they settle for plan ‘B’, which the agencies would be most willing to implement as long as they land the job. Target groups are left out of the scheme. The end result is a warped marketing programme that does not take into consideration the basic elements that should be considered in a good marketing effort. This results in an arch that reflects a flawed marketing programme that is used in promoting a poorly researched product.

This phenomenon is best illustrated with the bell curve that shows the relationship between anticipated impact and actual impact in a poorly researched product and an equally poorly implemented marketing plan. The outcome smacks of ineptitude, short-sightedness and an outright refusal to get help to do things right!

In the words of Patricia Seybold author of The Customer Revolution: How to Thrive When Customers are in Control, “the so-called New Economy is really the Customer Economy. This means that customers are in control – they are shaping businesses and transforming industries. Customers’ experience matters to your business direction. In other words, the feelings customers have when they interact with a particular brand determine their loyalty to that brand…” The moment companies see these values as sine qua non then they are ready to do business. It does not come on a platter of gold. Many factors go into creating a winning strategy when building customer loyalty. The first is consumer research, comprising of the various segments such as psychographics, demographics and microanalysis of each of the four consumer types as well as their stimulants. The other factors are advertising, promotions and all the other marketing tie-ins.

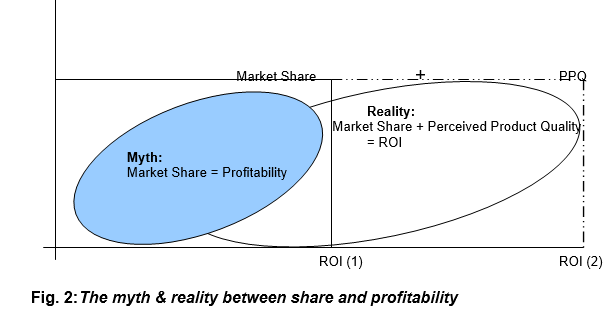

Another fallacy that is easily swallowed by most businesses is that a high share of market in a product category generally leads to economies of scale that result in a high level of profitability. To some extent this position still holds sway in the experience of some of our publicly quoted companies – Coca Cola Nigeria/Nigerian Bottling Company Plc, Nigerian Breweries Plc, Nestle Foods Plc, Cadbury Nigeria Plc as well as giants in the financial service industry, such as First Bank of Nigeria, Standard Chartered and United Bank for Africa Plc, etc. The bigger they are the more bullish their stocks. In fact, this postulation was first advanced in a study by Harvard Business School – that there is a strong correlation between market share and profitability – across a broad range of industries, companies and business units. Big meant better in everything.

One particular odious implication – a spin-off of the experience curve – is that a company could “buy” market share. Big discounts, for example or a heavy trade promotion could artificially create market share dominance, which in turn (it was argued) would yield the economies of scale essential to a high return on investment (ROI). Today, not much is being touted of the relativity between market share and profitability. But most proponents of the share-equals-profits connection – both consultants and corporate strategists – appear to have nibbled it only at the edge but not the whole way.

More recent evidence suggests that the relationship between share and ROI is much weaker than was previously discovered. “Perceived Product Quality” – PPQ – for example, is a dimension correlated with both share and ROI. Ignoring the underlying product quality factor in any share/profitability analysis greatly inflates the apparent correlation, i.e. the market share indicator tends to be overstated, leaving out product quality in the cold, which ties strongly to the earlier part of this discourse.

Taking it home, consider the vigour with which many industry components have chased market share more aggressively than corporate profitability. Note also, the heavy emphasis on promotional programmes among food products, bank products and other domestic products rather than determining what the consumer or customer wants. You can’t keep forcing bile down peoples’ throats and have a happy feeling about it! The result is that on realizing that the content is bile, people will regurgitate the contents, and then never go back to the vomit. It’s only logical. The consequence is a cannibalisation of that product or brand.

So, promotions can drive a market share but with a concomitant loss of profit; hear Roger Enrico, a one-time CEO of PepsiCo Worldwide Foods (trademark owners of Pepsi carbonated drinks): “Managing share without profit is like breathing air without oxygen. It makes you feel good for a while, but in the end it kills you…”

The bottom line is that market share is neither here nor there. At best, it is a proxy for ROI; it’s an alluring attraction on the road to decline. Market share is not the same thing as the real thing – return on investment. Market share is not static, it is dynamic and being able to capture a great share of the market today does not mean that you can retain that share for long. Managers and their advertising/marketing agencies should bear in mind that except they go the extra mile in enhancing product quality, have a strong understanding of the consumer that they serve, equating equity in a market segment with ROI becomes a suicidal marketing approach.

Is Market Share Same Thing As Return On Investment?: “If you don’t know where you are going, you’ll end up som… https://t.co/YhpD1DoaXZ

Is Market Share Same Thing As Return On Investment?: “If you don’t know where you are going, you’ll end up som… https://t.co/oCSpqkJkwS

Is Market Share Same Thing As Return On Investment?: “If you don’t know where you are going, you’ll end up som… https://t.co/jUSUyb4lbA

Is Market Share Same Thing As Return On Investment?: “If you don’t know where you are going, you’ll end up som… https://t.co/nSanvIkkR2

Is Market Share Same Thing As Return On Investment?: “If you don’t know where you are going, you’ll end up som… https://t.co/OoXLKvLJQe

RT @Penzaarville: Is Market Share Same Thing As Return On Investment?: “If you don’t know where you are going, you’ll end up som… https:/…

Is Market Share Same Thing As Return On Investment? https://t.co/quDtMQpeJg https://t.co/x5E9cHrGFk