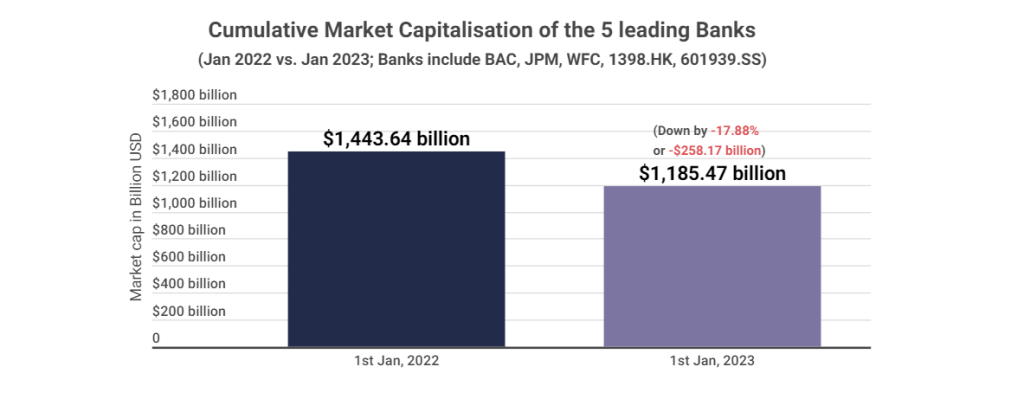

A new study has revealed that $258.17 billion was slashed off the market capitalization of the world’s five largest banks during the entire 2022.

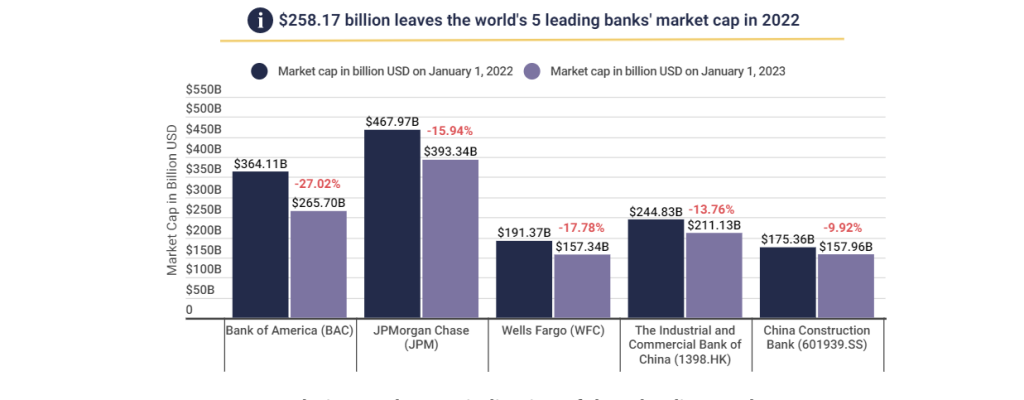

Data compiled by BitStacker found that JPMorgan Chase, Bank of America, The Industrial and Commercial Bank of China, Wells Fargo and China Construction Bank all saw at least a 9% drop in market capitalization for the period.

Interestingly, the most resilient bank was China Construction Bank, while Bank of America was the year’s biggest loser in terms of percentage market capitalization loss.

Details: BitStacker reviewed the market cap of the five leading banks in the world, from the 1st of January 2022, until the 1st of January 2023.

The banks were Bank of America Corporation (BAC), JPMorgan Chase (JPM), The Industrial and Commercial Bank of China (1398.HK), Wells Fargo (WFC) and China Construction Bank (601939.SS). The charts show a visual breakdown of the over $250 billion losses they incurred in the last year.

US banks hit hard in a difficult year

Bank of America endured a tough year that saw its market capitalization falling from $364.11 billion on January 1, 2022 to just $265.70 billion on January 1, 2023. This marked a loss of $98.41 billion representing a total percentage drop in market capitalization of 27.02% for the period.

While Bank of America was the year’s biggest loser in terms of the percentage of its market capitalization loss, JP Morgan Chase also suffered a disastrous 2022. The bank saw $74.63 billion wiped off its market capitalization for the period.

This marked a 15.94% fall in a year where the bank’s market capitalization slipped from $467.97 billion at the start of 2022 compared to just $393.34 billion at the end.

Wells Fargo was another major US bank who struggled amid the difficult economic conditions. The bank started 2022 with a market capitalization of $191.37 billion but this had fallen to $157.34 billion at the beginning of 2023. This represents a 17.78% fall in value with $34.03 billion wiped from the market capitalization of Wells Fargo.

The data in the study adds to the concerns raised in the recent news that the five leading US banks lost over $220 billion of market cap in 2022.

Chinese banks suffer a painful 2022

It wasn’t just US banks who experienced a disastrous 2022, as the two leading Chinese banks also suffered large losses in the year.

The Industrial and Commercial Bank of China was hardest hit as it saw its market capitalization slide from $244.83 billion on January 1, 2022 to $211.13 billion on January 1, 2023. This represents a fall of 13.76% in market capitalization for the period with $33.70 billion lost throughout the year.

Elsewhere, China Construction Bank was also hard-hit by the difficult economic conditions. The bank saw $17.40 billion wiped off its value in 2022 with its market capitalization worth $175.36 billion at the start of the year compared to $157.96 billion at the end. However, the fact that this was a 9.92% drop in market capitalization makes China Construction Bank the most resilient of the world’s five largest banks.

Understanding market capitalization

Market capitalization or ‘market cap’ is a term used to describe the total value of a publicly traded company’s shares. This is calculated by multiplying the company’s share price by the number of shares outstanding.

Such information is useful as it helps investors analyze the overall size of the company and evaluate what it is worth. Investing in a company with a larger market capitalization is felt to be a safer option because large market cap companies usually have a more stable history.

In contrast, those companies with a smaller market cap are felt to be a riskier option with the odds of failure being much higher. As a result, the fact that the world’s five largest banks all saw their market capitalization drop by an average of 16% in 2022 is a major concern for all prospective investors.