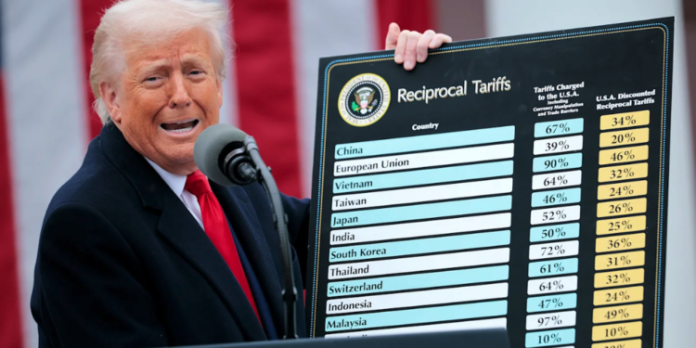

In a landmark policy shift, U.S. President Donald Trump has announced a 10% baseline tariff on all imports into the United States, alongside targeted reciprocal tariffs on countries imposing higher duties on American goods. The move, unveiled at a Rose Garden event titled “Liberation Day,” marks a dramatic departure from the free-trade principles that have shaped global commerce since World War II.

Trump framed the decision as the beginning of a new era of “fair trade,” pledging to revitalize American industries while pressuring foreign markets to open up to U.S. exports.

“This is one of the most important days in American history,” Trump declared. “We will supercharge our domestic industrial base, pry open foreign markets, and dismantle unfair trade barriers.”

The newly imposed tariffs, effective immediately, impact more than 50 countries, including key trade partners such as China, the European Union, India, and Japan, along with several developing economies across Asia, Africa, and Latin America.

Global Markets React

Financial markets initially responded with cautious optimism, as the announced 10% tariff was lower than the feared 20% rate. However, concerns remain over the long-term impact on global trade relations.

The list of affected countries includes:

| Country | Tariff on U.S. Goods | Proposed U.S. Tariff |

|---|---|---|

| Vietnam | 90% | 46% |

| Cambodia | 97% | 49% |

| Bangladesh | 74% | 37% |

| China | 67% | 34% |

| Thailand | 72% | 36% |

| Indonesia | 64% | 32% |

| India | 52% | 26% |

| Taiwan | 64% | 32% |

| South Korea | 50% | 25% |

| Japan | 46% | 24% |

| Malaysia | 47% | 24% |

| South Africa | 60% | 30% |

| Sri Lanka | 88% | 44% |

| Israel | 33% | 17% |

| Philippines | 34% | 17% |

| EU | 39% | 20% |

| UK | 10% | 10% |

| Brazil | 10% | 10% |

| Singapore | 10% | 10% |

| Chile | 10% | 10% |

| Australia | 10% | 10% |

| Turkey | 10% | 10% |

| Pakistan | 58% | 29% |

| Colombia | 10% | 10% |

Notably absent from the list is Nigeria.

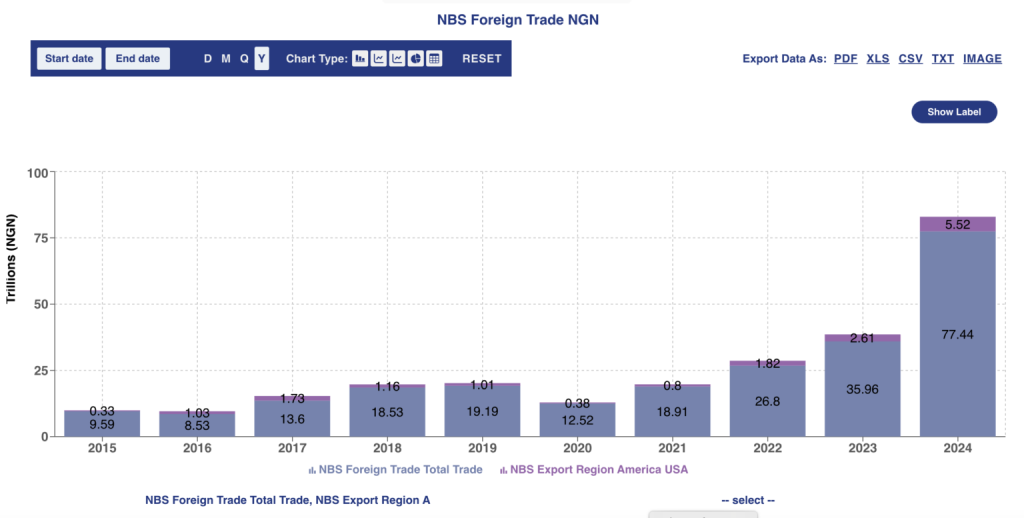

Nigeria’s Trade Relationship with the U.S.

According to data from Nigeria’s National Bureau of Statistics (NBS), the total trade volume between Nigeria and the U.S. amounted to approximately N31.1 trillion over the last decade (2015-2024). Imports from the U.S. during this period reached N16.4 trillion, representing 8.7% of Nigeria’s total global exports.

Understanding Trump’s Reciprocal Tariffs

At the core of Trump’s new trade policy is the concept of “reciprocal tariffs”, a strategy that imposes U.S. duties at half the rate of tariffs levied by foreign governments on American goods.

During the “Make America Wealthy Again” event, the Trump administration highlighted countries with some of the highest tariffs on U.S. goods, including Vietnam, Cambodia, and Bangladesh.

Under the new policy:

- Vietnam, which levies a 90% tariff on U.S. products, will now face a 46% tariff when exporting to the U.S.

- Cambodia, with a 97% tariff on American goods, will see a 49% duty imposed on its exports to the U.S.

- Bangladesh, imposing a 74% tariff on U.S. imports, will now be subject to a 37% duty.

Many of these nations have historically benefited from the U.S. Generalized System of Preferences (GSP), a program that grants preferential market access to developing economies. However, this new trade policy threatens to curtail or revoke these benefits.

Major Economies in the Crosshairs

Trump’s tariffs are not solely targeting smaller economies. China, long a focal point of his trade policies, imposes an estimated 67% tariff on U.S. goods and will now face a 34% U.S. import duty. Similarly, the European Union’s 39% tariff will be met with a 20% tariff on its exports to America.

Other affected nations include:

- India: 52% vs. 26% U.S. tariff

- Japan: 46% vs. 24%

- South Korea: 50% vs. 25%

- Taiwan & Indonesia: 64% vs. 32%

Despite concerns from allied nations, the Trump administration insists the measures are not punitive but aimed at restoring “fairness” in global trade, which it argues has historically disadvantaged the U.S.

Potential Impact on Nigeria and the Global South

While Nigeria is not currently on the list of targeted nations, the new trade policy signals a broader shift in U.S. engagement with emerging markets. Many developing economies dependent on U.S. imports, particularly in textiles, manufacturing, and agriculture, may soon face increased scrutiny or renegotiation of trade agreements.

For Nigeria, which has been pushing to diversify its non-oil exports through frameworks like the African Growth and Opportunity Act (AGOA), this policy shift presents both opportunities and risks. With countries like South Africa (60% vs. 30%), Sri Lanka (88% vs. 44%), and Pakistan (58% vs. 29%) now facing higher U.S. tariffs, Nigeria must ensure its trade policies remain favorable to maintain access to the American market.

Should Nigeria’s tariff regime be perceived as unfairly restrictive towards U.S. goods, the country could find itself subject to similar trade measures in the future.