…Chairman commits to continued investment as bank’s N748bn bad loan write-off signals new era of corporate governance

Femi Otedola, chairman of First HoldCo Plc, has outlined a governance framework anchored on transparency, accountability, and long-term value creation as the financial institution navigates the aftermath of a massive N748 billion bad loan write-off that decimated 2025 profits.

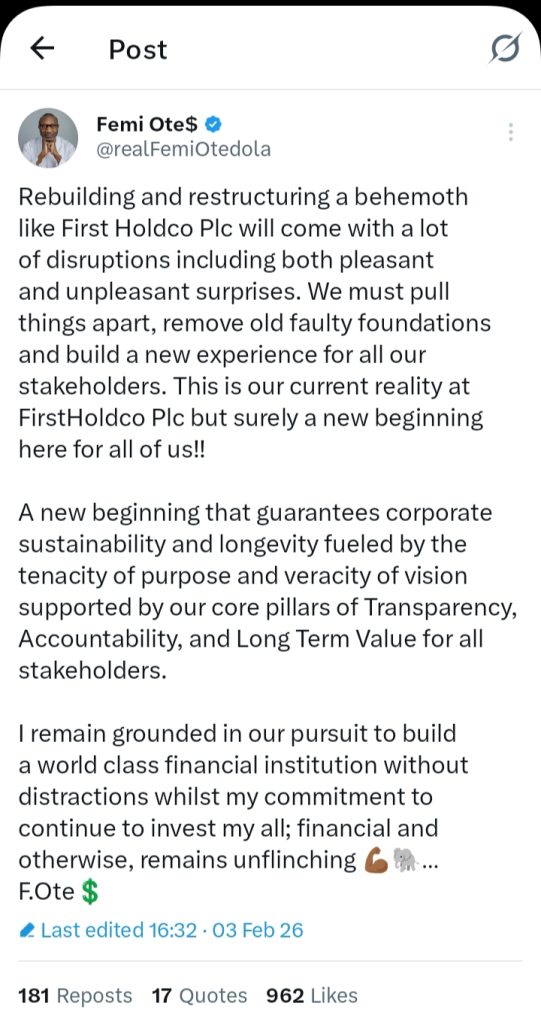

In a statement posted on social media over the weekend, the billionaire investor framed the dramatic provisioning as part of a necessary “rebuilding and restructuring” process that strips away “old faulty foundations” to establish sustainable corporate practices.

“A new beginning that guarantees corporate sustainability and longevity fueled by the tenacity of purpose and veracity of vision supported by our core pillars of Transparency, Accountability, and Long Term Value for all stakeholders,” Otedola stated, pledging his “unflinching” commitment to continue investing in the institution.

The three-pillar framework represents a departure from the opacity that characterized Nigerian banking’s handling of non-performing loans in recent years, and signals a shift toward more rigorous corporate governance standards at one of the country’s oldest financial institutions.

Transparency: Confronting the Full Scale of Legacy Problems

The transparency pillar was demonstrated in stark terms when FirstHoldco released unaudited 2025 financial results showing profit after tax crashed 93.36 percent to N44.98 billion from N677.01 billion in 2024, primarily due to elevated impairment charges totalling N748.13 billion.

Rather than defensively managing the narrative, Otedola explicitly owned the decision to fully recognize problem loans that had accumulated over years.

“At First HoldCo, we decided to clean house properly,” he explained in an earlier statement. “We took a huge one-time hit of N748bn to admit old bad loans instead of pretending they do not exist. That is why profit looks like it crashed by 92 percent. Painful headline, but it is a serious long-term move.”

This approach contrasts with industry practices where banks have historically rolled over or restructured troubled loans to avoid classification as non-performing, effectively deferring recognition of credit losses.

The transparency extends to acknowledging the root causes. Otedola attributed the timing partly to the Central Bank of Nigeria’s pressure on lenders to stop deferring problem loans following the end of regulatory forbearance granted during the COVID-19 pandemic.

“Why do this now? Because the CBN is pushing banks to stop kicking problems down the road,” he stated. “So First HoldCo basically closed the chapter on messy loans from past years.”

Accountability: Institutional Consequences and Discipline

The accountability pillar manifests in two critical ways: consequences for borrowers and institutional responsibility for past lending decisions.

On borrower accountability, Otedola emphasized that the aggressive provisioning “sends a clear message that borrowing has consequences, and it helps rebuild trust.” This signals a tougher stance on credit discipline going forward, potentially reshaping lending relationships that had operated on assumptions of indefinite forbearance.

For the institution itself, accepting a 93 percent profit decline represents accountability for past credit decisions and risk management failures that allowed such a large portfolio of troubled loans to accumulate.

The write-off effectively acknowledges that previous financial statements may have overstated asset quality by understating provisions, and that the bank is now willing to absorb the full cost of correcting that picture.

Long-term Value: Prioritizing Sustainability Over Cosmetics

The third pillar, long-term value creation, frames short-term pain as necessary investment in sustainable performance rather than cosmetic earnings management.

Otedola’s message to stakeholders is clear: “We must pull things apart, remove old faulty foundations, and build a new experience for all our stakeholders. This is our current reality at FirstHoldco Plc, but surely a new beginning here for all of us.”

The long-term value proposition rests on several premises. First, that a clean balance sheet positions the bank for sustainable growth without the drag of hidden problem assets. Second, that improved transparency will attract higher-quality investors and lower the cost of capital. Third, accountability mechanisms will prevent future accumulation of similar problems.

Critically, Otedola is backing this long-term orientation with his own capital. According to FirstHoldco’s 2025 financial statements, he increased his stake to 18.12 percent from 11.8 percent in 2024, representing a year-on-year increase of over 90 percent to 8.05 billion shares.

In December 2025 alone, he acquired additional shares worth N14.8 billion through Calvados Global Services Limited at N40.06 per share, demonstrating continued conviction even as the scale of provisions became clear.

“I remain grounded in our pursuit to build a world-class financial institution without distractions, whilst my commitment to continue to invest my all; financial and otherwise, remains unflinching,” Otedola stated.

The Governance Implications for Nigerian Banking

The three-pillar framework Otedola articulated extends beyond FirstHoldco to raise broader questions about governance standards across Nigeria’s banking sector.

As regulators intensify scrutiny following the end of COVID-era forbearance, other institutions face similar choices: maintain appearances through creative accounting, or accept short-term hits for long-term credibility.

Industry data shows non-performing loan ratios climbed to an estimated seven percent in 2025, exceeding the prudential limit of five percent, suggesting FirstHoldco’s problems are not isolated.

The question for investors is whether Otedola’s approach represents best practice that will eventually be rewarded, or a competitive disadvantage if peers continue masking asset quality issues.

His emphasis on transparency, accountability and long-term value implicitly challenges the sector’s historical norms around disclosure and provisioning adequacy.

Financial Foundation Beneath the Provisions

Despite the profit collapse, Otedola has emphasized that FirstHoldco’s underlying business remains robust. The bank reported N2.96 trillion in interest income and N1.91 trillion in net interest income, with gross earnings rising 4.8 percent year-on-year to N3.4 trillion, driven by a 36.3 percent increase in net interest income.

“The big number hides the fact that our operating business is strong,” he noted, distinguishing between one-time provisions and recurring operational performance.

Looking ahead, FirstHoldco announced its subsidiary, First Bank of Nigeria Limited, had met the Central Bank’s N500 billion minimum regulatory capital requirement ahead of the March 2026 deadline, positioning it for the recapitalization era.

“Now at First Bank and beyond, we go into 2026 lighter, cleaner and better prepared for the recapitalisation era and serious growth,” Otedola stated.

Market Reception and the Value Investor’s Dilemma

FirstHoldco’s stock has experienced volatility following the results release. The stock closed at N45 on January 30, 2026, down 2.5 percent on the day. It dropped further to N41.05 on Monday February 2 (down 8.78 percent) before rebounding to N45.15 on Tuesday February 3. Year-to-date losses stand at 6.05 percent, though the stock had gained 70.77 percent in 2025 before the full-year results were released.

The market response reflects the classic tension between short-term earnings metrics and long-term value creation that Otedola’s framework explicitly addresses.

For value investors, the situation presents a test case: Does aggressive transparency that damages near-term metrics ultimately create or destroy shareholder value? Is insider buying during maximum pessimism a contrarian signal or a value trap?

The three pillars Otedola outlined—transparency, accountability, and long-term value—provide a lens for evaluating these questions. If credible and sustained, they could differentiate FirstHoldco in a sector where governance concerns have historically plagued investor confidence.

The alternative interpretation is that every troubled institution claims to be pursuing transparency and long-term value while managing a crisis. The proof will be in execution and whether the pillars translate into measurable improvements in asset quality, operational efficiency, and stakeholder returns.

As Otedola framed it: “Rebuilding and restructuring a behemoth like First HoldCo Plc will come with a lot of disruptions, including both pleasant and unpleasant surprises.”

For investors, the question is whether to bet on the unpleasant surprises being largely behind the bank or whether more disruptions lie ahead despite the chairman’s unflinching commitment.