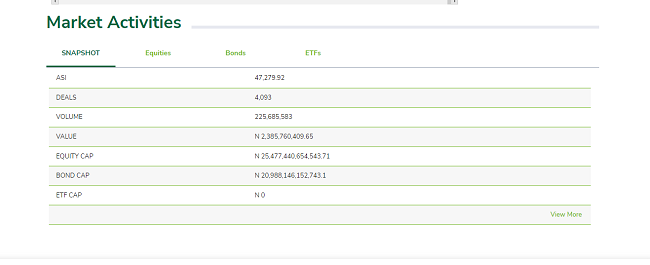

The Nigerian Exchange Limited’s (NGX) investors lost ₦27 billion as the market capitalisation closed at ₦25.47 trillion as opposed to the ₦25.504 trillion recorded on Thursday.

Deals, ASI, Volume

At the close of the stock market on February 4, 2022, NGX traded a volume of 225.69 million shares, valued at ₦2.39 billion, in 4,093 deals.

The All-Share Index (ASI) also declined by 49.88 points or 0.10 percent to close at 47,279.92 from 47,329.80 recorded on Thursday.

The market breadth closed with 18 gainers and 24 losers at the end of today’s trading on NGX.

Fidelity Bank topped the list of traders by volume, trading 24.85 million shares valued at ₦71.19 million.

RTBriscoe followed with 23.62 million shares estimated at ₦6.89 million, while Transcorp traded 16.39 million shares worth ₦18.53 million.

Chams sold 15.24 million shares worth ₦3.05 million, while Courtvellle Business Solutions traded 12.92 million shares worth ₦6.77 million.

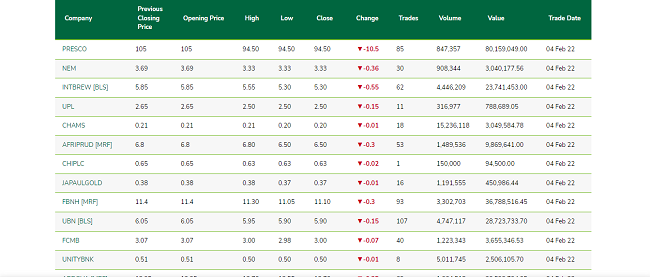

Losers’ List

Presco topped the ASI losers’ list, dropping by 10 percent to close at ₦94.50 per share.

NEM Insurance towed behind, losing 9.76 percent to close at ₦3.33, while International Breweries dropped 9.40 percent to close at N5.30 per share.

UPL dipped by 5.66 percent to close at N2.50, while Chams plunged 4.76 percent to close at N0.20 per share.

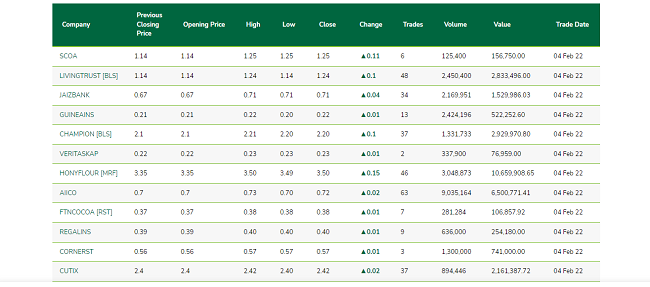

Top Gainers

SCOA led the gainers’ list in percentage terms, gaining 9.65 percent to close at ₦1.25 per share.

Living Trust Mortgage gained 8.77 percent to close at ₦1.24, while Jaiz Bank followed with 5.97 percent to close at ₦0.71 per share.

Champion Breweries rose 4.76 percent to close at ₦2.20, while Guinea Insurance gained 4.76 percent to close at ₦0.22 per share.