Nigeria’s overburdened health system is getting a major boost from powerful Artificial Intelligence (AI) technology through a new international health partnership.

Vantage Health Technologies an international health technology provider – part of the BroadReach Group – is teaming up with Nigeria’s Network for Health Equity and Development (NHED) a public health and development non-profit organisation.

NHED harnesses the power of AI and long-term in-country contextual expertise in health advocacy to build strong governance and health systems across Nigeria’s public health system.

The Nigeria health system is overburdened and resource-constrained resulting in poor health outcomes. Nigeria experiences a high prevalence of HIV, TB, and Malaria, ranking fourth worldwide in terms of HIV burden, accounting for 35% of cases in East and West Africa. Additionally, Nigeria ranks sixth globally in contributing to TB cases, comprising 4% of total TB cases worldwide.

Moreover, Nigeria faces the highest malaria burden globally, with an estimated 51 million cases annually, representing approximately 30% of Africa’s total malaria burden. To address these challenges, the partnership between NHED and Vantage plays a crucial role in providing the necessary support to enhance the efficiency and effectiveness of the healthcare system, its managers, and workforce within the available resources.

Vantage’s AI-powered solutions specifically help health organisations achieve cost and operational efficiencies, improved organisational performance and better health outcomes through “next best action” workflows to empower healthcare workers at all levels with deep experience in HIV, TB, malaria and other related diseases treatment and care.

NHED, in turn, specialises in delivering high-impact public health advocacy, governance and primary health system interventions across the continent. Specifically, within Nigeria, they have driven successful interventions across nutrition and primary healthcare programmes.

“Together, we’ll bring new efficiencies into the Nigerian public health system, to overcome challenges in health service delivery, workforce empowerment, patient retention, data interoperability, health information management and data-driven leadership,” says Paul Bhuhi, Managing Director of Vantage Health Technologies.

“Vantage offers proven AI-driven, data-centric, technology-enabled solutions and innovation that empowers human action. Our goal is to enable public health systems to achieve Universal Health Coverage by 2030.

“We believe this is possible in Nigeria too. Through our health systems approach, this partnership and its unique combination AI-enabled technology, deep contextual knowledge and expertise in health leadership and governance, can help address healthcare system challenges with speed and agility,” says Bhuhi.

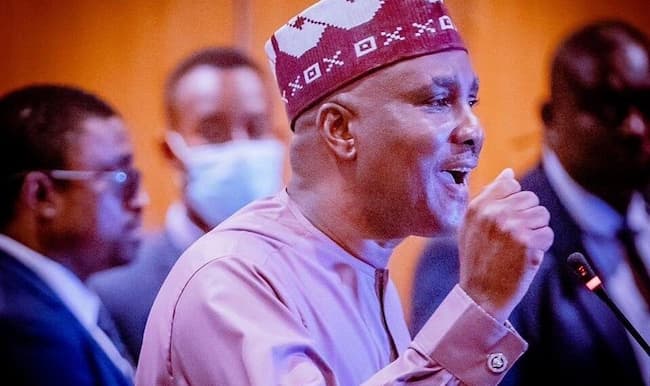

Dr Emmanuel Sokpo, Managing Director of NHED, says: “Our combined experience, local knowledge and relationships with the government of Nigeria enable us to offer high impact technical assistance and best-in-class, AI-driven, technology-enabled solutions.

“Our expertise and solutions bring about organisational change, improved performance, and better program, population, and individual health outcomes. We are excited to see the impact that this joint effort will make in Nigeria – not only for health administrators and caregivers, but most importantly their patients, the people of Nigeria.”

To introduce this powerful partnership, a round table event on “Technology enabled Health Systems Strengthening” is being co-hosted by the partnership on 20 July in Abuja, for high-level government, donor and private sector health stakeholders.