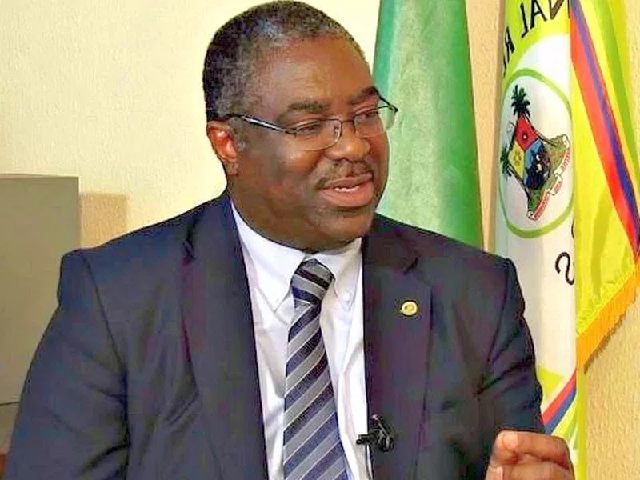

Babatunde Fowler, executive chairman, Federal Inland Revenue Service (FIRS), says Nigeria loses about $14 billion to tax evasion annually.

According to NAN, he saidfOWLER this on Wednesday while declaring open a seminar by the West Africa Tax Administration Forum (WATAF) in Abuja.

The three-day seminar was organised by WATAF in collaboration with Global Forum on Transparency.

“Nigeria looses about 14 billion dollars annually, if you look at the major economies, especially those in the extractive industry, South Africa, Ghana and Nigeria,” he said.

“They form bulk of the transactions, so one can safely assume that Nigeria maybe loosing between 14 billion dollars to 15 billion dollars annually to tax evasion.”

He said the increasing mobility of income and assets had created a major challenge for tax administrators in the sub region.

This, he said, was especially so because several information leaks released in the past years, had unveiled the depth and breadth of the challenge.

According to him, this shows that vast amount of money is being kept offshore and therefore, can go untaxed.

He, however, said that governments around the world were joining efforts to address the challenge.

The FIRS chairman said efforts were also being made to offer a global response to issues of international tax avoidance, tax evasion, illicit financial flows, money laundering and other harmful tax practices, using advanced technology.

Fowler said Nigeria on its part had demonstrated commitment to improving transparency around tax matters with the signing of a declaration as well as joining the Multilateral Competent Authority Agreement (MCCA) on automatic exchange of financial account information in 2017.

He said to facilitate the process of implementing the Automatic Exchange of Financial Account Information under the Common Reporting Standard (CRS), Nigeria had taken steps to ensure its full implementation.

To this end, Fowler urged countries in the ECOWAS sub-region that had not committed to implementing the AEQI standard to take necessary steps to do so.

“By the time we exchange financial transactions, we will be able to determine if tax revenue that is due to your country is actually being paid,” he said.

“We are working toward the same vision, and that is basically for us to keep track of financial transactions to make sure that tax revenue that is due to any country or organisation is not lost.

“We have situations where at times transactions are not cut or taxed to any particular location or country.

“We are trying to make sure that at the end of the day, all transactions can be taxed not only for Africa, or West Africa but globally.”

The seminar is being attended by tax administrators from Nigeria, Ghana, Togo, Burkina Faso, Cote Divoire, Mali, and Guinea