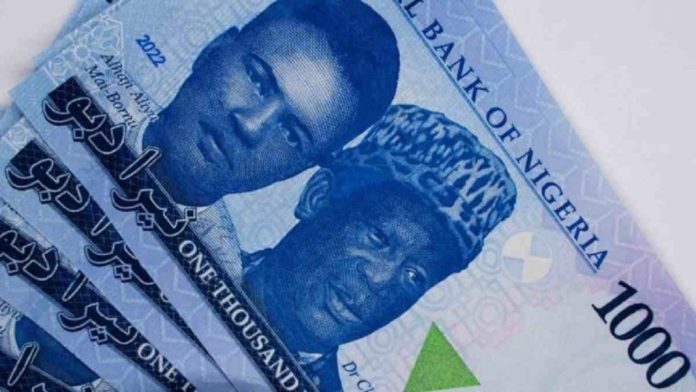

The naira appreciated against the US dollar last week as Nigeria’s Bonny Light crude price climbed to $81 per barrel, according to data from the Central Bank of Nigeria (CBN).

The local currency maintained relative stability, benefiting from a weaker dollar globally. The US dollar index held at 97.2 on Friday, near its lowest level since February 2022, after a four-day slide driven by rising expectations of Federal Reserve rate cuts.

CBN data showed the naira gained about N8 week-on-week, trading at N1,539.23/$ compared to N1,547.42/$ the previous week. In the parallel market, the naira closed at N1,565/$, narrowing the official-parallel market gap to around N26 from N33 a week earlier.

Meanwhile, Nigeria’s external reserves rose by 0.78% to $37.37 billion, supported by fresh FX inflows.

On the commodities front, global crude oil prices posted weekly losses due to easing geopolitical tensions in the Middle East, reducing fears of supply disruptions. Brent crude fell to around $68 per barrel, while WTI hovered just above $65. However, Nigeria’s Bonny Light showed resilience, inching up to $81 per barrel.

In the equities market, the Nigerian Exchange (NGX) reported that total transactions surged by 45.3% to N700.50 billion in May from N482.04 billion in April, driven by increased activity from both domestic and foreign investors.

Domestic investors’ transactions rose by 38.8% to N581.59 billion, supported by higher retail and institutional participation. Foreign investor inflows rebounded strongly, rising by 88.5% to N118.91 billion from N63.07 billion in April, amid moderating fixed-income yields and improved market sentiment.

However, net flows in the equities market declined by 54% to N2.64 billion in May, down from N5.74 billion in April, as strong net foreign inflows of N13.31 billion were offset by net domestic outflows of N10.67 billion.

“In the near term, we expect domestic investors to remain the primary drivers of transaction value, supported by an anticipated decline in fixed-income yields, which is expected to sustain buying interest,” analysts at Cordros Capital said.

They added that the relative stability of the naira could further encourage foreign participation in the equities market, although global uncertainties remain a downside risk to sustained inflows.