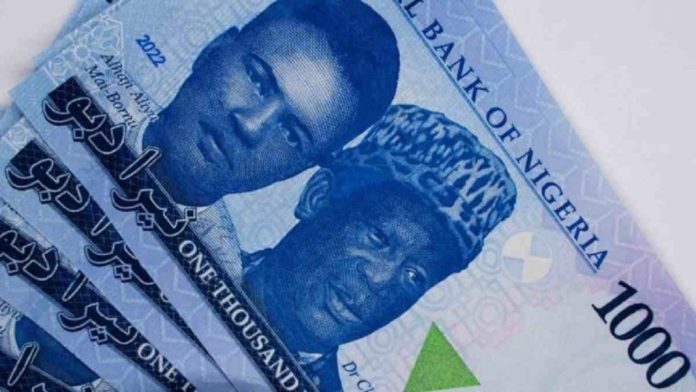

The Nigerian naira appreciated against the US dollar last week, buoyed by a $190.4 million intervention by the Central Bank of Nigeria (CBN) aimed at boosting dollar supply to authorized dealer banks.

The exchange rate closed at ₦1,580.44/$1 at the official market, gaining 1.14% over the week amid improved FX liquidity and relatively low dollar demand. According to Lagos-based AIICO Capital, the CBN’s intervention helped stabilize market activity, with trades fluctuating between ₦1,575 and ₦1,610.

The NAFEX fixing rate also improved, moving from ₦1,602.38 to ₦1,580.44 by the end of the week. Midweek trading was boosted by foreign investor inflows, while exporters added supply towards the end of the week.

CBN data showed Nigeria’s external reserves rose by $182.79 million to $38.56 billion, supported by inflows from undisclosed sources.

Analysts expect the naira to remain stable in the short term due to continued central bank interventions, despite ongoing liquidity constraints and limited foreign portfolio inflows. In the forwards market, naira rates appreciated across all tenors:

- 1-month: ₦1,623.11 (+1.1%)

- 3-month: ₦1,682.77 (+1.5%)

- 6-month: ₦1,770.17 (+1.6%)

- 1-year: ₦1,938.74 (+2.6%)

Despite recent gains, analysts warn that a major naira rally remains unlikely amid global economic uncertainties and subdued investor sentiment.

Meanwhile, oil and gold markets saw notable movements. Brent crude rose 0.54% to $64.78 per barrel, and U.S. WTI settled at $61.53. Gold surged 2.1% to $3,362.70 an ounce, recording its best week in six, driven by U.S. trade tensions and a weakening dollar.