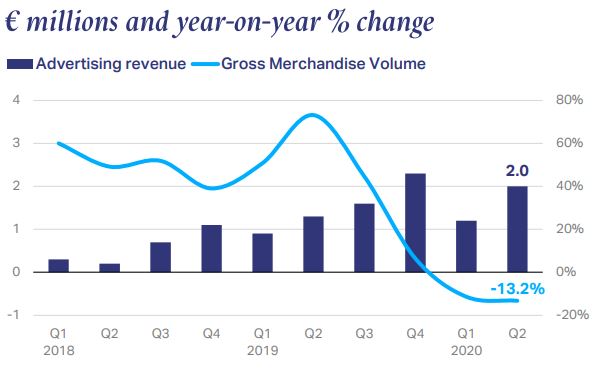

Jumia, the African e-commerce start-up, earned €2.0m in advertising revenue in Q2 2020, only the second time it has reached this total. Triple-digit growth was the standard last year, and Q2 2020’s rise of 49.7% was more rapid than Q1’s 33.7%.

Warc stated this in its latest Global Advertising Trends report: The pivot to e-commerce summarising the latest research from Warc’s Data platform.

Major advertisers like P&G, L’Oréal, Samsung and Unilever have all used the platform. Jumia also saw 6.8m orders in Q2 2020, a rise of 8.4% year-on-year. However, the value of those orders fell 13.2% for the same period.

SOURCE: Jumia Technologies AG

The business has faced major challenges over the last year – shutting down in Cameroon, Rwanda and Tanzania and battling strong competition from international companies – like Amazon – and from small local businesses that are increasingly selling online.

Advertising investment across e-commerce sites such as Amazon, Tmall and Rakuten, omnichannel retailers such as Walmart and Carrefour, and social commerce on platforms such as Pinduoduo and TikTok is set to increase 18.3% worldwide, growing 30 times faster than the wider online ad market and in stark contrast to a forecast fall of -8.1% for the total advertising industry this year.

The uptick in e-commerce advertising spend mirrors a rapid increase in online purchasing; consumers will spend an additional $183bn online this year as a direct result of Covid-19 with total e-commerce sales set to rise by 30.4% – $677bn – to $2.9trn worldwide. Brands are flocking to leverage targeted advertising across e-commerce platforms as a means of getting closer to the consumer at the point of purchase.

Consumers will spend an additional $183bn online this year due to Covid-19

Online sales are set to rise by 30.4% to $2.9trn worldwide this year, according to data from Edge by Ascential. This represents a forecast upgrade of 8.2 percentage points – $183bn – since the Covid-19 outbreak began. Domestic growth rates range from +19.0% in the UK, to +22.1% in the US and +37.6% in China.

Taken together, e-commerce sales will account for 88% of global retail growth in 2020. The top five platforms will tighten their grip on the market this year, turning over an additional $529bn combined as a result of the outbreak. E-commerce platforms Alibaba (+$221bn), Pinduoduo (+$122bn) and Amazon (+$92bn) have seen the sharpest forecast upgrades since the outbreak.

Advertising spends – particularly within the FMCG sector – is moving online as a result of the shifting complexion of sales since the Covid-19 outbreak. Over 8% of Unilever’s business is now done online – the company made 71% (€2.2bn) of its total 2019 e-commerce sales in just the first six months of 2020.