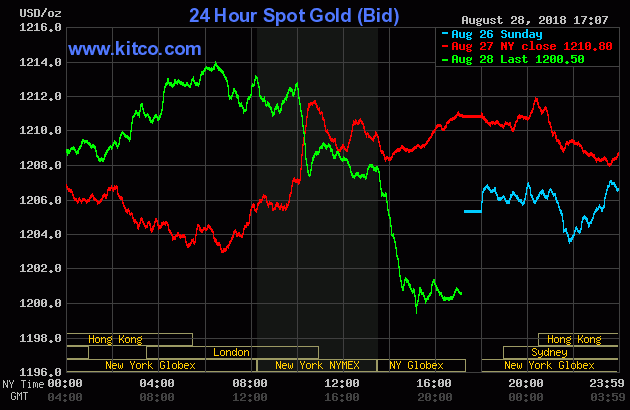

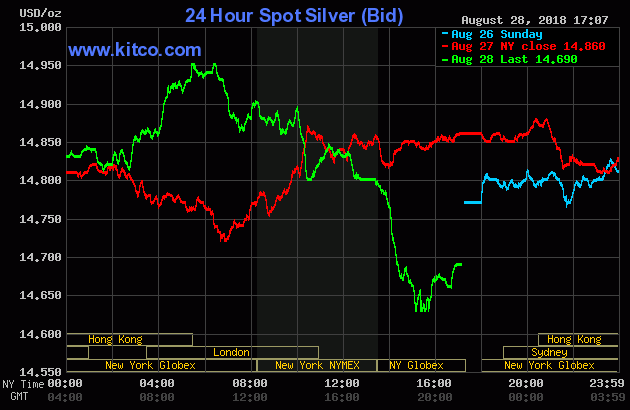

Gold prices are slightly lower in early-afternoon U.S. trading Tuesday, after hitting a two-week high overnight. Some normal profit-taking from the shorter-term futures traders was featured today, following decent gains the past few sessions that do suggest the yellow metal has put in a near-term market bottom. December gold futures were last down $1.40 an ounce at $1,214.60. December Comex silver was last down $0.062 at $14.91 an ounce.

A weaker U.S. dollar index on this day was a bullish element for the precious metals markets that did limit the downside pressure. However, with little risk aversion among traders and investors at present, the upside for the safe-haven metals will likely be limited. U.S. stock indexes hit new record highs again today.

The world marketplace is still buzzing about the U.S. and Mexico coming to terms on a trade agreement. World stock markets rallied on the news. Some now reckon the U.S. will get to work on agreements with its other major trading partners, including the EU and China. However, President Trump has indicated he’s in no rush to make a deal with China.

The other key outside market today finds Nymex crude oil prices weaker on a corrective pullback from recent good gains, and trading around $68.50 a barrel.

Technically, gold bears still have the overall near-term technical advantage but a price downtrend on the daily bar chart has been negated to suggest a market bottom is in place.

Gold bulls’ next upside near-term price breakout objective is to produce a close in December futures above solid resistance at $1,226.00. Bears’ next near-term downside price breakout objective is pushing prices below solid technical support at the August low of $1,167.10. First resistance is seen at today’s high of $1,220.70 and then at $1,225.00.

First support is seen at this week’s low of $1,209.30 and then at $1,200.00. Wyckoff’s Market Rating: 3.0

December silver futures bears have the overall near-term technical advantage, but prices hit a two-week high overnight. Silver bulls’ next upside price breakout objective is closing prices above solid technical resistance at $15.50 an ounce.

The next downside price breakout objective for the bears is closing prices below solid support at $14.00. First resistance is seen at today’s high of $15.07 and then at $15.25. Next support is seen at this week’s low of $14.82 and then at $14.555. Wyckoff’s Market Rating: 2.5.