Analysts at Financial Derivatives Company Limited (FDC) have predicted that the foreign exchange rate will become harmonised or converge at the Investors and Exporters window.

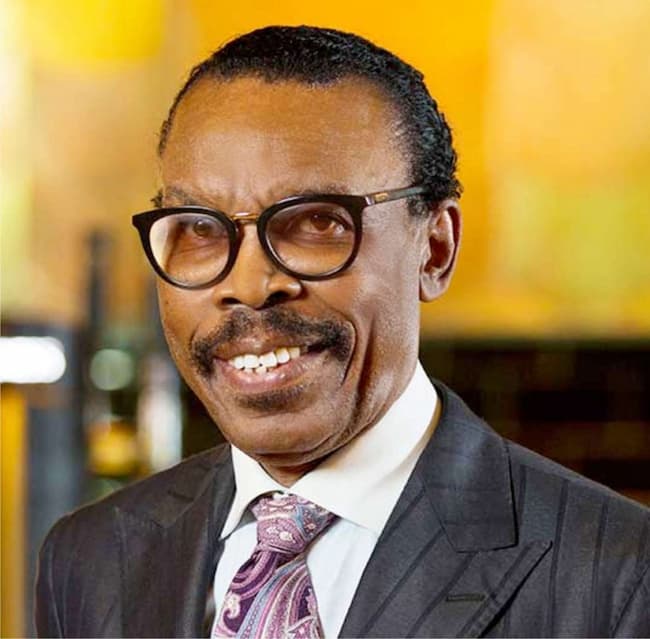

The analysts led by Mr Bismarck Rewane, in a new report warned the the Bureaux De Change (BDC) operators could either survive the new CBN policy or become extinct.

The CBN had last week announced the suspension of foreign currencies sales to BDC across the countries, alleging that they were engaging in illegal activities.

The new policy had affected the parallel market exchange rate, leading to the plunging of naira to dollar rate to N525/$ the next day as the markets tried to process the implications of the CBN’s decision on businesses.

READ ALSO: Institute Ranks Nigeria Among Countries With Least Affordable Food

The analysts said the parallel market rate depreciation would continue, although temporarily, leading to a widening of the forex market premium.

“However, as the market adjusts to the new forex ban, the spike in the parallel market premium will fizzle out, leading to a convergence of rates around the IEFX window,” they added.

“However, the cumbersome documentation process required by banks will remain a challenge for the public. We expect the markets to adjust to the new norm, while the BDCs will be forced to survive or become extinct in the new forex market era,” the analysts said.

They said, “Since then, the naira has gradually appreciated, to currently trade at N508/$ (August 4). Other market rates have also appreciated. For instance, the IATA rate (the exchange rate used by airlines to issue tickets) moved from N460/$ to N412-N413.

“Since the CBN is expected to shift the forex supply previously sold to BDCs to the banks, we expect to see an increase in volume and turnover in the banking segment of the forex market, making dollar sales more accessible to the public. This will lead to an appreciation of the exchange rate for invisibles such as PTA (personal travel allowance), BTA (business travel allowance), tuition, etc.”