The Federal Inland Revenue Service (FIRS) says Nigerians will now pay stamp duties on WhatsApp messages, SMS, and messages via any electronic platform acknowledging receipt of funds.

The revenue service also stated that stamp duties will be paid on “POS receipts, fiscalised device receipts,

Automated Teller Machine (ATM) print-outs”.

According to an information circular published by the agency, and seen by TheCable, Nigerians will also be required to pay stamp duties on SMS acknowledging receipt of funds.

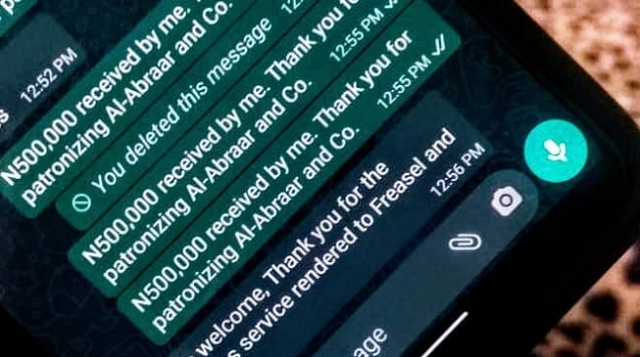

FIRS gave illustrations of situations where Nigerians are expected to pay stamp duties, one of them says: “ABZ Ltd’s chief accounting officer, after receiving a cash payment of N500,000 from Mr. XYZ on behalf of ABZ Ltd., composed a message which reads: ‘receipt of N500,000 is hereby acknowledged’ and sent same to Mr. XYZ via WhatsApp messenger”.

“In this case, the WhatsApp message acknowledging the receipt of N500,000 constitutes a receipt for which stamp duty is payable.

“Mr XYZ is required to make a disclosure of the details of the transaction using FIRS e-stamp duty platform or to the relevant stamp duties Commissioner. This will lead to assessment and payment of appropriate stamp duties and a consequential issuance of a stamp duty certificate or an acknowledgement.

“Such certificate or acknowledgement will suffice as evidence that stamp duties have been paid and that the electronic receipt has been stamped appropriately.”

The agency adds that “all electronic dutiable instruments or receipts”, including e-mails, short message service (sms), instant messages (IM), any internet-based messaging service, are subject to stamp duty.

The circular, issued in April, clearly stated that “all printed receipts” and “all electronically generated receipts and any form of electronic acknowledgement of money for dutiable transactions” are liable to duty payment.

PWC FAULTS ENFORCEMENT

In its analysis of the circular, PwC Nigeria said a major issue with the Stamp Duties Act (SDA) in its current form is the “practicability of enforcing compliance”.

“The practical application of this is doubtful and even where the FIRS attempts to enforce this, taxpayers may challenge the FIRS’ definition of the term, as the Act itself does not provide a definition.

“While the Circular encourages the payment of stamp duties via the FIRS’ e-platform, there have been complaints that the platform does not facilitate bulk remittance of stamp duties, as the platform only allows individual stamping of documents. The FIRS should address this.

“In general, the SDA (enacted in 1939) needs to be repealed and re-enacted to be in tune with modern day business and economic realities.”

The Finance Act (FA) 2019 introduced some amendments to the Stamp Duties Act (SDA) which necessitated this recent circular by the FIRS.

In line with the amended SDA, a N50 stamp duty is payable on any bank deposit or transfer of N10,000 or more, except deposits or transfers between accounts maintained by the same person in the same bank.