- Senate set to confirm CBN deputy governors ahead of MPC

Key Indicators

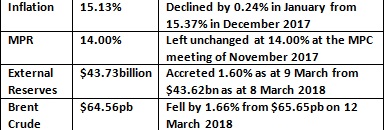

Bonds

The Bond market witnessed a significant decline in yields in today’s session, as market players refreshed their offers significantly below their previous day levels on the back of the FGN bond offer circular released by the DMO showing a 50% cut in total offered size from the initial guidance of c.N140bn In the Q1 calendar. Yields consequently declined by c.15bps on average, as investors continued to hit mainly on the 2021s and 2027s.

We expect yields to maintain a downward trend tomorrow, but on a more moderate tone, even as market players anticipate results from the February inflation report to be published tomorrow. Proceeds from coupon payments on the 2024s (c.N51bn) is also expected to drive some interests from clients.

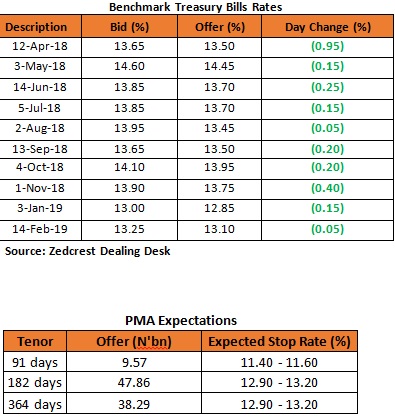

We consequently expect significant declines in stop rates at the PMA scheduled for tomorrow, with bids from mandate clients expected to take yields significantly below their current market levels.

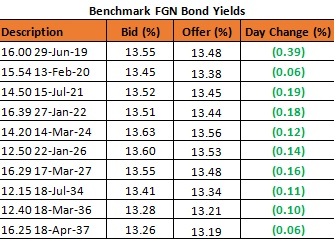

Treasury Bills

The T-bills market also traded on a significantly bullish note as market players reacted to a similar cut (50%) in the Q2 PMA calendar circulated yesterday by the CBN. Yields consequently declined by c.15bps on average, with significant demand witnessed on the April and Nov maturities, as the CBN also held off on OMO.

We expect a continued downtrend in yields tomorrow, as market players anticipate inflows for Retail FX refunds and OMO T-bill maturities of c.N261bn, whilst also noting that the PMA maturities would only be partially rolled over, with a total amount of c.N95bn expected to be repaid.

Money Market

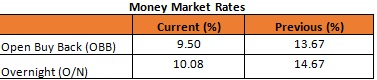

The OBB and OVN rates declined to 9.50% and 10.08%, as system liquidity remained robustly positive at c.N116bn, in absence of an OMO auction by the CBN. We expect rates to crash below 5% levels tomorrow, due to expected inflows from retail FX refunds to banks by the CBN and coupon payments (N51.12bn) 0n the 2024 bond.

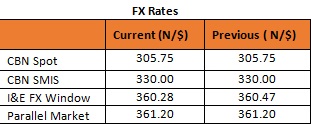

FX Market

The Interbank rate remained stable at its previous rate of N305.75/$, with the CBN’s external reserves also recorded to have improved by 1.60% to $43.73bn as of 9 March. The NAFEX rate appreciated by 0.05% to close at N360.28/$, with total volume traded declining by about half of its previous day’s level to $322m, even as offshore flows into Fixed income continues to drive significant flows in the market. Rates in the Unofficial market remained stable at N361.20/$.

Eurobonds

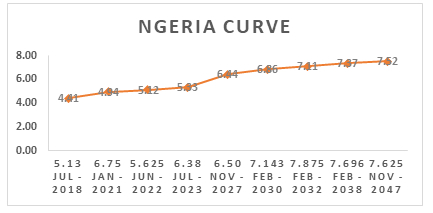

The NGERIA Sovereigns remained relatively flat in today’s session, except for slight buys we witnessed on the new 2030 issue.

The Nigerian banks were also mostly quiet with slight demand for the Access sub 21s and Zenith 22s as market players were mostly focused on the recently issued Seplat 23s.

The Seplat 23s which were finally issued at a discounted level of 99.263 (9.50% yield vs 9.25% coupon) traded as high as 100.625 (9.06%) before settling just below 100 on slight profit taking from some successful auction bidders.

Source: Proshare