- FG raises the alarm over the looming fiscal crisis

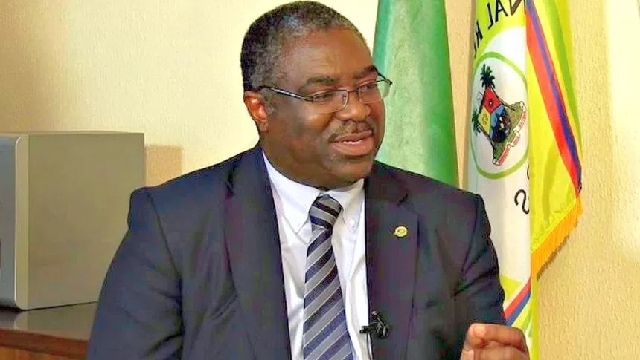

Federal Inland Revenue Service (FIRS) Executive Chairman, Mr. Babatunde Fowler, yesterday replied the presidential query, giving detailed explanations on the reasons for the variances between the budgeted revenue collections and the actual collections from 2015 to 2018.

The Chief of Staff to the President, Mr. Abba Kyari, in a query dated August 8, 2019, had given Fowler till yesterday to explain why revenue collection fell below expectations during the period under consideration.

The FIRS boss was directed to submit a comprehensive variance analysis, explaining the reasons for the variances in revenue collections during the period under review.

However, apparently embarrassed by the media report on the query, the federal government yesterday allayed fears that Fowler was under investigation just as it warned of a looming fiscal crisis if the incidence of revenue collection shortfall persists.

In his response to the query via a letter with reference number FIRS/EC/CWP/0249/19/030, and dated August 19, 2019, the FIRS boss attributed the variances between the budgeted revenue collections and the actual collections during the period under review to many factors, including the onset of economic recession in the early years of the Muhammadu Buhari administration.

Responding to the allegation that actual collections for a three-year period (2016 to 2018) were significantly worse than what was collected between 2012 and 2014, he said total collection for the said period was N14, 527. 85 trillion, while total collection between 2016 and 2018 was N12, 656.30 trillion.

The highlights of these figures, according to him, is that during 2012 to 2014, out of the N14,527.85 trillion that was collected, oil revenue accounted for N8,321.64 trillion or 57 percent, while non-oil accounted for N6,206.22 trillion or 42.72 percent.

Fowler stated that from 2016 to 2018, out of the N12, 656. 30 trillion that was collected, oil revenue accounted for N5,145. 87 trillion or 40.65 percent while the non-oil sector accounted for N7,510.42 trillion or 59.35 percent.

Besides, he said, while FIRS had control of non-oil revenue collection figures, oil revenue collection figures were subject to more of external forces.

According to him, from his analysis, non-oil revenue collection grew by N1,304.20 trillion or 21 percent within the period of 2016 to 2018.

He also added that the total budgeted collection figure for 2012 to 2014 was N12,190.22 trillion, compared to the high budgeted figure of N16,771.78 trillion from 2016 to 2018, which represents an increase of 37.58 percent.

“The low inflow of oil revenues for the period, especially Petroleum Profit Tax (PPT) was due to fall in the price of crude oil and reduction of crude oil production. Notwithstanding government efforts to diversify the economy, oil revenues remain an important component of total revenues accruable to the federation.

The price of crude oil fell from an average of $113.72, $110.98 and $100.40 per barrel in 2012, 2013 and 2014, to $52.65, $43.80 and $54.08 per barrel in 2015, 2016 and 2017.

There was also a reduction in crude oil production from 2.31 million barrels per day (mbpd), 2.18mbpd and 2.20mbpd in 2012, 2013 and 2014, to 2.12mbpd, 1.81mbpd, and 1.88mbpd in 2015, 2016 and 2017, respectively,” Fowler added.

The FIRS boss also recalled that the country went into recession in the second quarter of 2016, which slowed down general economic activities.

According to him, tax revenue collection – Company Income Tax (CIT), and Value Added Tax (VAT), which are collectively a function of economic activities, were negatively impacted.

He, however, added that even with the recession, the actual collection of VAT and CIT was still higher in 2016 to 2018 than in 2012 to 2014.

“During the years 2012, 2013 and 2014, GDP grew by 4.3 per cent, 5.4 per cent and 6.3 percent, while in 2015, 2016 and 2017, there was a decline in growth to 2.7 per cent, -1.6 per cent and 1.9 per cent, respectively. The tax revenue grew as the economy recovered in the second quarter of 2017,” Fowler added.

He said the strategies adopted by FIRS in the collection of VAT during the period 2015 to 2017 led to about 40 per cent increase over what was collected in 2012 to 2014, adding that N802 billion was collected as VAT in 2014, while N1.1 trillion was collected in 2018.

He also stated that when the present FIRS leadership came in August 2015, the two major non-oil taxes were increased by 52 percent for VAT and 45 percent for CIT.

Fiscal Crisis Looms, Says Presidency

Meanwhile, the presidency yesterday raised the alarm over what it described as looming fiscal crisis if deliberate steps are not taken to end what it described as “negative trends in target setting and target realisation in tax revenue.”

This warning was contained in a statement by Senior Special Assistant to the President on Media and Publicity, Mallam Garba Shehu, in response to a presentation by Vice-President Yemi Osinbajo, at the ongoing presidential retreat for ministers-designate in Abuja.

Shehu, who clarified the statement that Fowler was not under any investigation as being circulated in some quarters, said such rumour was only the fallout of a letter written to Fowler by Kyari, demanding an explanation from him on why there were shortfalls in revenue collection.

He added that presidential warning against possible fiscal crisis yesterday was driven by Osinbajo’s disclosure that “projected revenue of government falls behind recurrent expenditure even without having factored in capital expenditure.”

He stated: “Following reports making the rounds in some media outlets, it is necessary to state categorically that the Chairman of the Federal Inland Revenue Service (FIRS), Mr. Babatunde Fowler, is not under any investigation.

“The letter from the Chief of Staff to the President, Abba Kyari, on which the purported rumour of an investigation is based, merely raises concerns over the negative run of the tax revenue collection in recent times.

“Taking a cue from today’s (Monday) presentation of Vice President Yemi Osinbajo, which dwelt on an ‘Overview of the Policies, Programmes and Project Audit Committee,’ a body he chaired, projected revenue of government falls behind recurrent expenditure even without having factored in capital expenditure.

“Consequently, it would appear that the country might be heading for a fiscal crisis if urgent steps are not taken to halt the negative trends in target setting and target realization in tax revenue.

“Anyone conversant with Federal Executive Council deliberations would have observed that issues bordering on revenue form the number one concern of what Nigeria faces today, and therefore, often take a prime place in discussions of the body.

“It is noteworthy and highly commendable that under this administration, the number of taxable adults has increased from 10 million to 20 million with concerted efforts still ongoing to bring a lot more into the tax net.”

Source: THISDAY