The Executive Vice Chairman, Signal Alliance, Mr. Collins Onuegbu has advised SME owners to embrace the services of angel investors to accelerate the growth of their business.

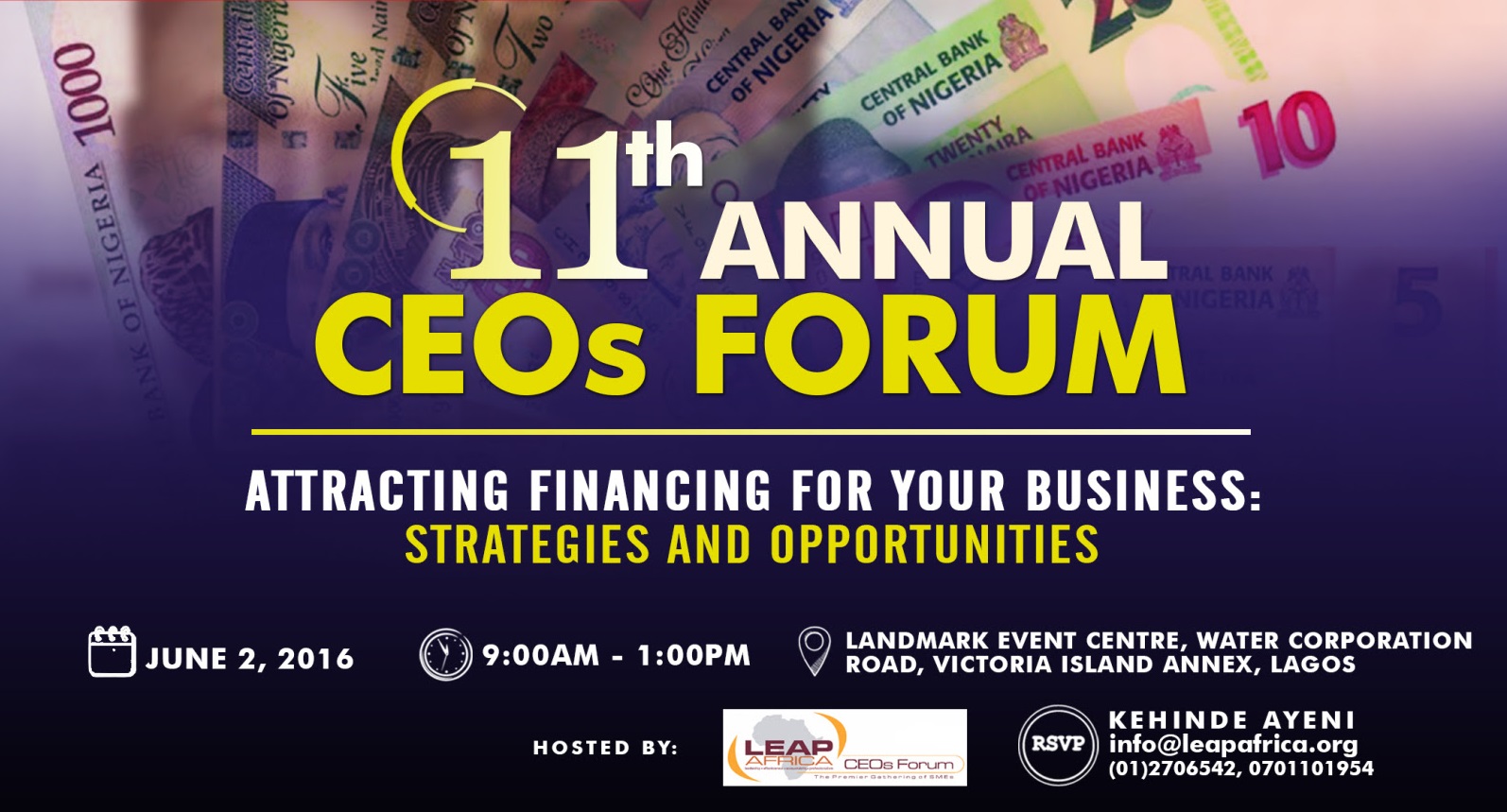

He said this at the 11th Annual CEO Forum organized by LEAP AFRICA which held in Lagos with the theme: “Attracting Financing For Your Business: Strategies And Opportunities”.

Onuegbu explained that: “An angel investor is an affluent individual, who provides capital for a business start-up, usually in exchange for convertible debt or ownership equity.

“You need an angel investor to scale-up your business. And when do you need the services of an angel investor? I think the best time is at the start stage when you are just coming up, when you have not yet made some mistakes in your business decisions. So that’s the best time to seek the services of an angel.”

“Although, getting one might be difficult, you have to persevere. Normally, they will be turning you around, telling you to give them time to think about it. But you just have to keep talking to them, you need to talk to banks and those that you know can come in,” he added.

Also contributing, Partner, Adleva Capital, Mr. Folabi Esan, who spoke on the “Prerequisites For Accessing External Financing,” advised business owners to ensure good corporate governance, adequate financial record and understanding the strength of management team, saying that these are what prospective investors would look out for before coming to invest in the business, adding that a sound business model and profile should be adopted and strictly adhered too.

Esan said: “It’s very imperative for you as the CEO of your company to ensure there is good governance in your company; that there is policy scrutiny and enforcement. That the rules set out for your company is being adhered to.

“Also, there should be good financial record of all your business transactions; record of your income and expenditure, record of all business agreements and deals.

“Have a strong management team that can be able to make worthwhile inputs. More importantly, the model of your business should be able to achieve the motive of the business, and if it doesn’t, then you remodel.”

“Again, your company should have good profile. Company profile is its reputation. So people know your company through you; if you have good profile it reflects on your company and if you have bad profile, automatically people withdraw from your business,” Esan added.

“So the bottom line is that for you to be able to access fund for your business from external sources, all these need to be put in place,” he noted.