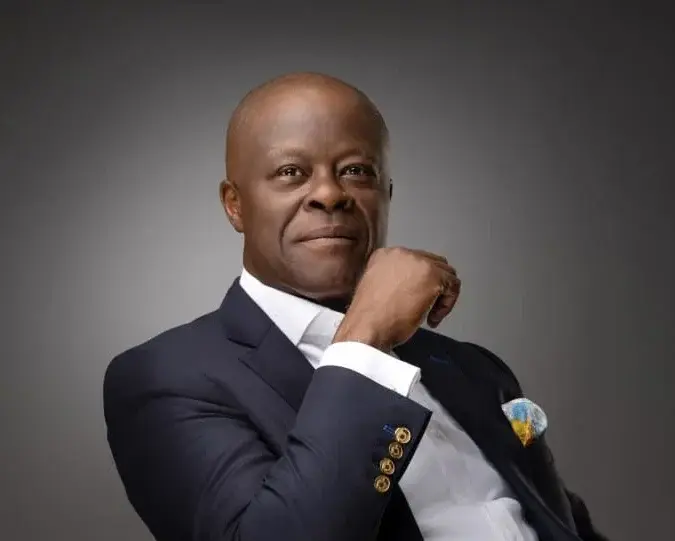

The Federal Government announces plans to raise around $1.7 billion through Eurobonds to address revenue gaps in the 2024 budget. The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, confirms this development during a press briefing at the State House in Abuja.

In addition to the Eurobond, the government plans to issue Islamic Sukuk bonds to raise an extra $500 million, leveraging international money market instruments to secure needed capital.

Budget Financing Strategy

Nigeria’s 2024 budget stands at N28.7 trillion (approximately $17 billion), with a projected deficit of N9.1 trillion ($5.2 billion) to be covered through borrowing. While specific issuance dates for the Eurobond have not been disclosed, Edun notes that the borrowing plan will be submitted to the National Assembly this year, aiming for swift legislative approval.

“This new borrowing forms part of the amended Nigerian 2024 Appropriation Act,” Edun states. Earlier in the year, Nigeria successfully raised about $900 million through its first domestic dollar bond issuance.

Potential Rise in External Debt

The planned Eurobond issuance is set to reintroduce Nigeria to the global debt markets, yet it may also lead to a rise in the country’s external debt, which currently stands at approximately $42.9 billion—accounting for nearly 39% of the total debt stock.

To date, Nigeria has largely relied on domestic borrowing instruments such as Federal Government Bonds, Treasury Bills, and Open Market Operations (OMO). However, the country’s domestic debt has reached around N66.9 trillion as of Q2 2024, representing about 60% of the total debt portfolio. One of the challenges of increasing foreign debt is the higher interest costs, exacerbated by the naira’s depreciation, which makes servicing external debt more expensive.

IMF Raises Concerns

In September, Nigeria issued $500 million in domestic foreign currency bonds, which were oversubscribed to $900 million. At the time, Edun ruled out issuing Eurobonds due to concerns over high debt servicing costs amid volatile dollar securities.

However, ongoing revenue shortfalls, largely due to low crude oil production, have made the Eurobond issuance critical to address budget deficits. The International Monetary Fund (IMF) has expressed caution regarding Nigeria’s plans to issue additional dollar-denominated bonds, warning that such measures could increase pressure on the naira and elevate the costs associated with servicing naira-based debt.

Furthermore, the IMF highlights potential risks in the government’s strategy to issue domestic foreign exchange securities, noting that it could fragment the market and impact dollar liquidity in the official exchange rate market.