In the world of trading, mastering the art of reading candlestick charts is akin to understanding a unique language—one that, when fluently spoken, can unlock numerous opportunities and insights. Japanese candlesticks, a methodology dating back centuries, are particularly revered for their ability to succinctly capture market sentiment and price movements within a given time frame.

The Essence of Japanese Candlesticks

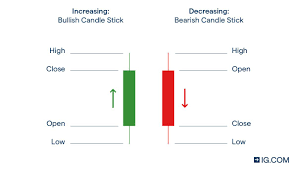

Japanese candlesticks are more than just a visual representation of market data; they are a story of the battle between bullish and bearish forces. Each candlestick is a narrative of the struggle for control of the market within a specified period. The ‘real body’ of the candlestick represents the range between the opening price and the closing price. A longer body signifies a more intense fight between buyers and sellers. The color of the body indicates who won: a white or green body means the buyers (bulls) had the upper hand, while a black or red body shows sellers (bears) were in control.

The ‘upper shadow’ and ‘lower shadow’ of the candlestick provide additional context, revealing the highest and lowest price points during the entire session, respectively. When these components—real body, upper shadow, and lower shadow—come together, they form patterns that traders scrutinize for hints about future price movement.

Deciphering Candlestick Patterns

Japanese candlestick patterns are the alphabets of this language, with each pattern offering a unique insight. Common candlestick patterns include single candle formations like the bullish engulfing pattern, where a larger bullish candle ‘engulfs’ a smaller bearish one, often indicating a bullish reversal pattern. Double candlestick patterns, such as the bearish harami, signal a potential reversal in the opposite direction.

But how do these patterns play out in real-world trading scenarios? Let’s delve into some examples, supported by a concise table, to illustrate the power of candlestick analysis.

| Pattern Name | Type | Description | Market Implication |

| Bullish Engulfing | Bullish Reversal | A small bearish candle followed by a larger bullish candle. | Indicates potential upward trend. |

| Bearish Harami | Bearish Reversal | A large bullish candle followed by a smaller bearish candle. | Suggests a possible downward trend. |

| Doji | Neutral | A candle where the opening and closing prices are nearly the same. | Signifies market indecision. |

This table is a simplified guide. In practice, traders combine these patterns with other forms of technical analysis to make informed decisions.

Beyond the Patterns

While recognizing Japanese candlestick patterns is crucial, successful trading involves understanding the context in which these patterns occur. For instance, a bullish engulfing pattern might be more significant if it appears after a prolonged downtrend. Similarly, the effectiveness of bearish patterns like the bearish harami increases when they occur after a notable uptrend.

To demonstrate the practical application of these principles, consider the case of a forex broker bonus. Such a bonus might be an attractive proposition for traders looking to maximize their trading potential. However, savvy traders wouldn’t jump in blindly. They would first analyze the forex market using Japanese candlesticks and technical analysis to understand the current trend and momentum. If the candlestick charts indicate a bullish trend, this might be the right time to leverage the forex broker bonus and enter the market.

Practical Insights from Japanese Candlestick Patterns

Traders often rely on Japanese candlestick patterns for short-term trading strategies. For example, if a trader observes a series of bullish candlestick patterns in a particular stock or currency pair, they might interpret this as a sign of an impending bullish run. Conversely, a series of bearish patterns could signal an upcoming bear market.

However, it’s not just about spotting a pattern; it’s about interpreting it in the context of recent price movements and market conditions. A bullish pattern following a long period of bearish activity could signify a stronger turnaround than one that appears in a fluctuating market.

Implementing Japanese Candlesticks in Trading Strategies

Japanese candlesticks are integral to many trading strategies. Traders often combine them with other indicators for a more robust analysis. For instance, when a bullish engulfing pattern aligns with a significant increase in trading volume, it reinforces the likelihood of a bullish reversal. Similarly, if a technical analysis indicator like the Relative Strength Index (RSI) shows an asset being overbought or oversold, Japanese candlestick patterns can offer additional clues about potential price direction changes.

It’s crucial to remember that no single pattern guarantees success. Japanese candlesticks offer probabilities and suggestions, not certainties. Successful traders incorporate them into a broader, disciplined approach, often combining technical analysis with fundamental analysis and sound risk management practices.

Understanding the Doji Pattern

The Doji is one of the most intriguing candlestick patterns, representing a unique scenario where the opening and closing prices are virtually the same. This equilibrium between the opening price and the closing price results in a very thin or nonexistent ‘real body’, often referred to as a ‘very small body’.

The Doji pattern resembles a cross or a plus sign and is widely regarded as a symbol of indecision in the market. Particularly significant when it appears after a sustained trend, the presence of a Doji, with its very small body, can suggest that the market’s current momentum is losing strength, potentially signaling an upcoming reversal. For example, in a bearish market characterized by a series of downward candles, the emergence of a Doji pattern could be an indication that sellers are starting to lose their dominance, potentially leading to a bullish reversal.

The Significance of the Bullish Engulfing Pattern

In contrast to the uncertainty indicated by the Doji, the bullish engulfing pattern is a powerful bullish signal. This pattern occurs when a small bearish candle is followed by a large bullish candlestick, completely overshadowing the previous period’s price action. It’s a clear sign that the bulls have taken control from the bears. This pattern is particularly significant when it appears at the end of a downtrend, as it suggests a strong reversal of fortunes.

Key Reversal Patterns in Candlestick Charting

In the realm of candlestick charting, understanding reversal patterns is crucial for predicting potential changes in market direction. Here’s a list of some key reversal patterns:

1. Bullish Engulfing Pattern: Indicates a possible bullish turnaround.

2. Bearish Engulfing Pattern: Suggests a potential bearish shift.

3. Doji: Signals market indecision, often preceding a reversal.

4. Hammer and Hanging Man: Both have small bodies and long lower wicks, indicating potential reversals.

5. Three Black Crows Pattern: Three consecutive long-bodied bearish candles, signifying a strong bearish trend.

These patterns are particularly effective when combined with other technical indicators, enhancing a trader’s ability to make informed decisions.

Candlestick Analysis vs. Traditional Line Charts

Candlestick analysis offers a more nuanced view of market dynamics compared to traditional line charts, which only display closing prices. Candlesticks, by contrast, provide a wealth of information by showing not only the closing price but also the opening price, highs, lows, and the emotional sentiment of the market. The candlestick body and wicks reveal the intensity of buying or selling pressure and can often preempt future trends. For example, a long upper wick might indicate that buyers attempted to push the asset’s price higher, but were ultimately overpowered by sellers.

Advanced Techniques in Candlestick Charting

Advanced traders often delve deeper into candlestick charting, identifying patterns that may not be immediately obvious. An example of such a pattern is the “Three White Soldiers,” indicative of a strong bullish trend. This pattern is characterized by three consecutive long, bullish candles, suggesting a decisive upward movement in the market. These kinds of patterns offer insights that are not readily apparent in other forms of charting, which might focus solely on closing prices. By recognizing these advanced patterns, traders can gain a more nuanced understanding of market dynamics and potential future trends.

Applying Candlestick Patterns in a Trading Strategy

Incorporating candlestick patterns into a trading strategy requires not only the ability to identify patterns but also an understanding of the broader market context as depicted on a price chart. These patterns can be applied across various financial instruments, from stocks to forex. The key is to integrate candlestick analysis with other technical and fundamental analysis methods to form a comprehensive trading strategy.

For instance, a trader might use the bullish engulfing pattern as an entry signal in a trading strategy, but only if it aligns with other bullish indicators, such as a rising moving average or a bullish news event. Conversely, the appearance of a down candle following a bearish candlestick pattern could prompt a trader to exit a position, especially if it coincides with other bearish signals, confirming the strength of the bearish trend. In conclusion, candlestick charting is a powerful tool for traders, offering a depth of information that extends far beyond just the opening and closing prices of an asset. Whether it’s a bullish engulfing pattern signaling a potential upward move or a pattern hinting at a bearish turn, these patterns provide crucial insights. By effectively integrating candlestick patterns into their trading strategies, traders can enhance their ability to navigate the complexities of financial market