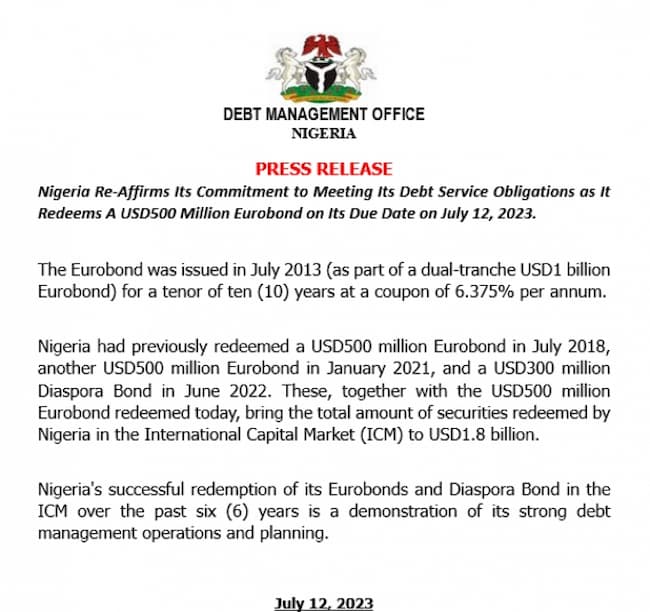

The Debt Management Office (DMO) revealed that Nigeria has redeemed $500 million Eurobond on its due date of July 12, 2023.

A eurobond is a debt instrument denominated in a currency other than the country or market in which it is issued.

The DMO stated in a statement on Wednesday that the successful redemption of the Eurobond demonstrates the country’s commitment to meeting its debt servicing responsibilities.

According to the debt management firm, the Eurobond was issued in July 2013 (as part of a dual-tranche USD1 billion Eurobond) for a ten-year term with a coupon of 6.375 percent per annum.

“Nigeria had previously redeemed a USD500 million Eurobond in July 2018, another USD500 million Eurobond in January 2021, and a USD300 million Diaspora Bond in June 2022,” the statement reads.

“These, together with the USD500 million Eurobond redeemed today, bring the total amount of securities redeemed by Nigeria in the International Capital Market (ICM) to USD1.8 billion.

“Nigeria’s successful redemption of its Eurobonds and Diaspora Bond in the ICM over the past six (6) years is a demonstration of its strong debt management operations and planning.”