The Nigeria Customs Service (NCS) has maintained its position on the imposition of excise duties on carbonated drinks to boost its revenue generation.

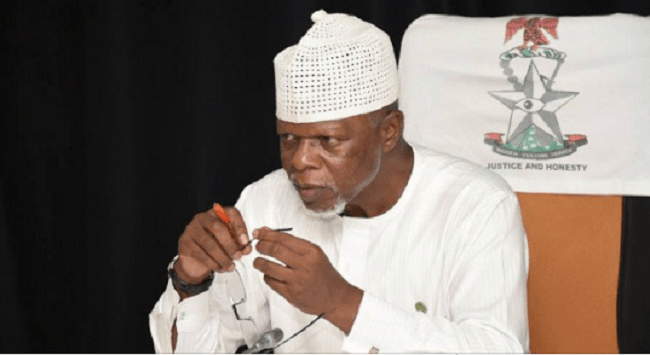

This was made known by the Comptroller-General of Customs, Hameed Ali, during a public hearing on the 2022-2024 Medium Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP) in Abuja which was held on Wednesday, he noted that the Customs revenue generation was hinged on market forces that drive imports to Nigeria.

He stated that t excise duties payment should apply to local manufacturers, and not only imported carbonated drinks.

He noted that, presently, excise duties collection by the NCS is limited to tobacco and alcoholic beverages.

Ali blamed smuggling at the various borders as the reason for the NCS’s inability to reach its revenue generation target, saying that smuggling had become a way of life for some people. He, however, stated that the NCS had set up structures to tackle smuggling.

READ ALSO: Reps Name Four Banks Over Failure To Remit N10.6bn Customs Duty

He stated that NCS was on the close to deploying three scanners at the nation’s seaports “for proper and speedy examination of containers entering the country”.

He, however, did not address the issue of all the scanners procured by former Destination Inspection service providers and taken over by the Nigeria Customs Service, which the service has since abandoned.

“The border communities do not want to cooperate in fighting smuggling because of absence of government in their communities. Sometimes they cooperate with the smugglers because of the support they receive from the smugglers,” he said.

Hameed Ali stated that the service recorded N1.5trillion revenue generation in 2020, while N1.02trillion has been generated in the first six months of 2021.