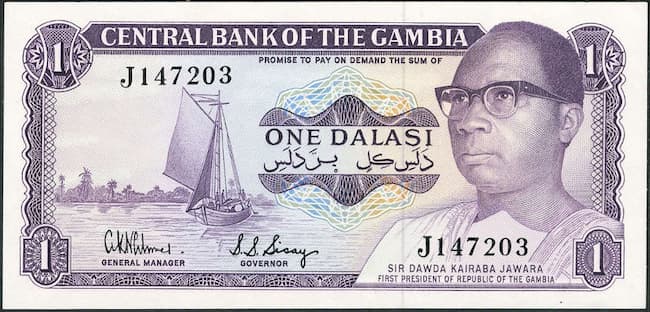

The announcement by the Central Bank of Nigeria (CBN) of its agreement with the apex bank of The Gambia to print its local currency, the Gambian dalasi, has left many Nigerians questioning the CBN’s ability to take on such business, as, to many, the venture seems ambitious for a struggling economy.

The popular belief, although not entirely accurate, is that Nigeria does not print its own legal tender and, therefore, was not qualified to take on the task of printing the dalasi.

This belief is given a shadow of credence by the CBN on its website where it stated that the naira is printed by the Nigerian Security Printing and Minting Company (NSPM) and, sometimes, printed in “other overseas companies, and issued by the CBN.”

Earlier this week, the Governor of the Central Bank of The Gambia, Buah Saidy, disclosed that it had declined an offer from the International Monetary Fund (IMF) to assist in the restructuring of its operations, stressing that contracting the CBN would serve the best interest of Gambians.

Who Prints the Naira?

Prior to 1963, when the Nigerian Security Printing and Minting Company (NSPM) Limited Plc was created, the naira was printed overseas. However, full operations did not commence until 1965.

Yet, years after its creation, it fell into dormancy, and the naira was still printed outside the country, as disclosed by the former governor of the CBN, Charles Soludo, in 2006 who said that it regrettable that Nigeria was the “only country in the world that had a mint but still imported currency.”

But in 2019, the Director of Currency Operations of the CBN, Mrs. Prinscilla Eleje, said that “the CBN no longer prints the naira abroad as all currencies are printed by NSMPC.”

READ ALSO: Wheat Development Programme Yield Underscores The Role Of Research, Trials

Resilient Belief

In a seasonal fashion, the enduring narrative that the naira is printed overseas makes wave, and the recent news that the CBN would be printing the Gambia’s local currency, the dalasi, has created a resurgence, triggering the disbelief in the CBN’s ability to handle such project.

Among the agreements reached by the Nigerian and the Gambian’s governments, include the fact that the CBN would also work with the Gambian Central Bank to restructure operations at the latter.

Assuring the Gambian delegation, the Governor of the CBN, Godwin Emefiele, said that “Our colleagues will see how they can help you to restructure your Central Bank and also see how we can be of assistance in printing your currency.

“I can assure you that we can be extremely competitive, if only from the standpoints of logistics and freight. The Gambia is only a few hours from here.”

In response to the assertion by Emefiele regarding Nigeria’s capacity to print the dalasi, a professor and economist from the University of Ibadan, Prof. Lanre Olaniyan was quoted by NAN as saying “I am aware that we have been printing the naira from outside. But we have the NSPM, which is supposed to do these things. If it is presently working, that is good for everybody.

“The proposal from the Gambia shows that we have the capacity to print our own currency independently and save some foreign exchange.”

Any Economic Benefits?

Experts have identified the economic benefits of such endeavour, noting that it sets a precedence for the African Continental Free Trade Agreement (AfCFTA), to which Nigeria is signatory.

The Director-General of the Lagos Chamber of Commerce and Industry (LCCI), Dr. Muda Yusuf, said that Nigeria needs more of this services, as it can be classified as an “export” service.

He said, “That kind of partnership is export. We need export of services. It is a fantastic idea, and shows that people are demanding for our services.

“It will bring us a lot of value. The more of those services we can render to other countries, the better, especially now that we are talking about the African Continental Free Trade Agreement (AfCFTA). It is good for the economy.”

The agreement between the two countries was described as a “silver lining” for the CBN “in recent times” by a senior lecturer at the Lagos Business School (LBS), Mr. Bongo Adi.

Adi said that although the NSPM was poorly managed for a long stretch of time by previous governments, and was only resuscitated under the current administration, it had one of the best printing facilities in Africa, “if not the world”.

“It [the NSPM] is supposed to also have sort of a commercial aspect that would take on businesses like the private sector,” despite it being owned “partly by the government and the CBN” and other bodies, Adi said.

“I think that’s a good thing. I think that is a silver lining for the CBN in recent times, having been able to resuscitate the mint that was there for so long. I think that is kudos to Emefiele and, of course, to President Muhammadu Buhari.”

“It’s a good thing that even [The] Gambia is approaching them. That shows that they have state-of-the-art facilities, they have international competitive printers such that other countries can entrust them with the printing of their security documents.

“That is very sensitive thing, very strategic. It’s not something that countries would go to print anywhere. So, that The Gambia is approaching Nigeria for that is a sign that something good is coming.”