Financial analysts say the declining inflation rate reported by the National Bureau of Statistics (NBS) when there is marked increase in commodity prices is an indication that there is a bias in Consumer Price Index (CPI) basket.

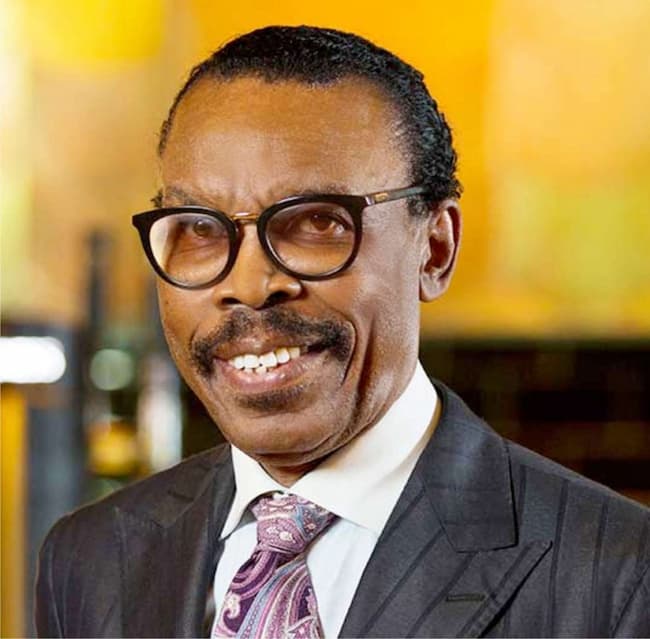

Analysts at Financial derivatives Company (FDC), led by its Chief Executive Officer, Bismarck Rewane, said a decline in inflation only meant that commodity prices are increasing slowly.

While pointing out that the last food basket was constituted in 2009, they advised the NBS to update it to capture the changing food patterns of Nigerians and economic status of the country.

“It is often advised that a country reconstitute its inflation basket periodically (5-years interval). This is to capture the changing consumption patterns of households.

“In Nigeria, the last time the basket constituents were revised was in 2009. This could lead to a significant bias in the measure of inflation and ultimately affect policy decision making.

“To eliminate this bias, it is important that the CPI basket is revised to reflect current market and economic realities.”

The analysts expressed shock at the fall in Headline inflation and Food inflation in April.

The NBS had reported that Nigeria’s headline inflation for April fell slightly by 0.05 percent to 18.12 percent from 18.17 percent in March, the first decline since August 2019.

READ ALSO: Nigeria’s Inflation Rate Drops To 18.12%- NBS

Also, Food inflation reduced marginally to 22.72 percent from 22.95 percent in March.

According to the analysts, the decline in inflation rate is not sustainable as core inflation recorded an increase due to increase in inflation rate of non-food items such as healthcare (15.88 percent) and transport (14.87 percent).

They said, “It is worth mentioning that a decline in inflation does not necessarily imply that prices are falling. It simply means that commodity prices are increasing albeit at a slower pace.

Of all the inflation sub-indices, only core inflation increased. All non-food items increased particularly healthcare (15.88 percent) and transport (14.87 percent). This suggests that inflation is yet to reach an inflection point. Hence, the decline in inflation is not likely to be sustained.”

They predicted that the inflation rate will rise in May due to output shocks and supply chain disruptions as a result on insecurity in the country.

According to them, the falling inflation rate would be the crux of discussions at the Monetary Policy Committee (MPC) meeting that will be held next week.

READ ALSO: High Inflation Level Dampens Purchasing Power – LCCI

“All eyes will now be on the MPC at their meeting next week to see their reaction to the unexpected drop in inflation. The GDP numbers are scheduled for release on May 24. We are projecting a mild contraction of 0.5 percent,” FDC analysts said.

“Our view is that the committee would maintain its current stance and watch the indicators closely. This is because inflation is likely to increase again in the month of May due to output shocks and supply chain disruptions as a result of heightening insecurity. This will be compounded by exchange rate pressures and higher logistics costs.”