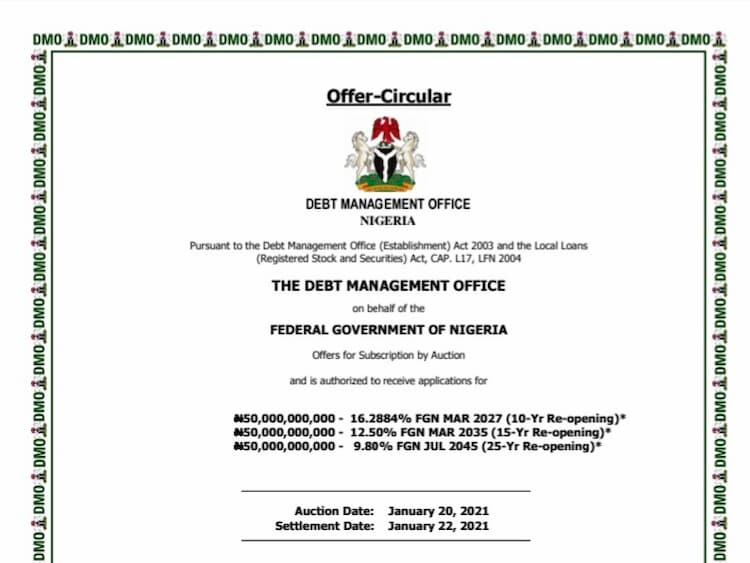

The Nigerian Government through the Debt Management Office is scheduled to auction N150bn worth of bonds on January 20, 2021.

The DMO, in its bond subscription offer for January, reopened the MAR-2027, MAR-2035 and APR-2045 bonds, offering investors N50bn, each on the three tenors.

The Debt Management Office in a notice stated that it was authorised to receive applications for the subscription on behalf of the Federal Government.

The agency said the N150bn bonds consisted of a reopening of N50bn 10-year bond at a rate of 16.29 per cent, N50bn 15-year bond at the rate of 12.5 per cent and N50bn 25-year bond at the rate of 9.80 per cent.

For reopening of previously issued bonds (where the coupon is already set), successful bidders usually pay a price corresponding to the yield-to-maturity bid that clears the volume being auctioned, plus any accrued interest on the instrument.

The circular said the bonds would be auctioned on January 20, 2019, and would be settled on January 22.

It added that the interest on the bonds would be payable semi-annually while a bullet repayment of the redemption would be made on the maturity date.

The circular read in part, “The bonds are offered at N1,000 per unit subject to a minimum subscription of N50,001,000 and in multiples of N1,000 thereafter.

“They qualify as securities in which trustees can invest under the Trustee Investment Act as they are backed by the full faith and credit of the Federal Government of Nigeria and are charged upon the general assets of Nigeria.

READ ALSO: DMO: Nigeria Owes The IMF, World Bank, Others N32.22tn

“The bonds also qualify as government securities within the meaning of Company Income Tax Act and Personal Income Tax Act for tax exemption for pension funds among other investors. They are listed on the Nigerian Stock Exchange and the FMDQ OTC Securities Exchange.”

The DMO said the bonds qualified as liquid assets for liquidity ratio calculation for banks.

It said the accredited dealers for the transaction were Access Bank Plc, Citibank Nigeria Limited, Coronation Merchant Bank Limited, Ecobank Nigeria Limited, FBNQuest Merchant Bank Limited, First Bank of Nigeria Limited and First City Monument Bank Plc.

others are FSDH Merchant Bank Limited, Guaranty Trust Bank Plc, Stanbic IBTC Bank Plc, Standard Chartered Bank Nigeria Limited, United Bank for Africa Plc, , Zenith Bank Plc, and Guaranty Trust Bank Plc.