-

Buyers flocking to stocks that are resilient to trade war

- Gree Electric, Shanghai International Airport out of favor

Foreign investors are zeroing in on health-care and consumer stocks and ditching some old favorites, as they sift through the spoils of a $2 trillion selloff in China’s equity market.

Foreign investors bought liquor makers, sold appliance makers during rout

Chinese shares have been on a downward slide since hitting a more than two-year high in January, as investors worried about Beijing’s campaign to rein in leverage and its impact on liquidity, as well as corporate defaults, the slowing economy and an intensifying spat over trade and technology investment between China and the U.S.

The CSI 300 Index of Chinese large cap stocks has fallen 23 percent from its Jan. 24 high. Its consumer staples sub-gauge — which includes Moutai — is the third best performer on the index over that period, despite falling 14 percent. The health-care sector is the one bright spot, advancing 8.1 percent as a group. Jiangsu Hengrui has helped lead the charge with a 19 percent gain.

The outperformance of health-care stocks is a reflection of the growing middle class in China wanting better medical coverage, while steadily improving living standards have buoyed consumer stocks, said Tai Hui, chief market strategist at JPMorgan Asset Management in Hong Kong.

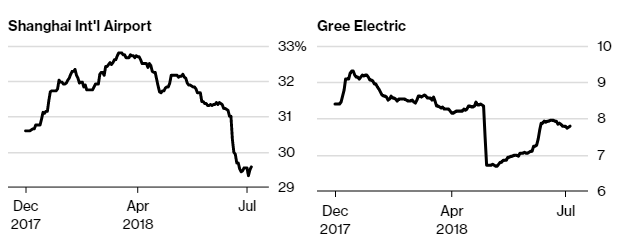

Stocks Seeing the Biggest Selling

According to Hong Kong Stock Exchange data, foreign investor ownership of Gree Electric via the trading links has fallen to 7.9 percent from 9.1 percent in January. It slipped to as low as 6.7 percent in late April, when the home appliance maker skipped a dividend payout for the first time in 11 years.

BNP’s Maurer said the selling reflects investor concern about China’s housing market.

While Shanghai International Airport remains popular among foreign investors — who hold almost a third of the company — that hasn’t stopped them from selling stock this year. Corrine Png, chief executive officer of Crucial Perspective Pte. in Singapore, wrote last month that it’s increasingly likely the escalating trade dispute spurs China to impose curbs on outbound tourism to the U.S.

See Also: Trump Ramps Up Trade War With $200 Billion List of China Duties

Getting Out

Foreign investors have lowered holdings in Shanghai International Airport, Gree

NOTE: Percentage refers to holdings as of total number of listed shares

Equities Foreigners Are Seeking Out

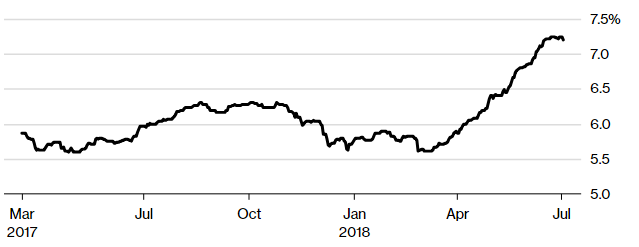

International investors have bought a net 12 billion yuan ($1.8 billion) of Moutai shares since January, though the world’s biggest distiller by market value has seen its stock drop 6.6 percent since then. Foreign holdings of Moutai and fellow liquor maker Wuliangye Yibin Co. are both near at least 15-month highs.

“Foreign buying of consumption-related names could continue, as more foreign funds are expected to flow into the A-share market in the second half thanks to the weakening yuan, cheap valuations and inclusion of onshore stocks in the MSCI Inc. indexes,” said Banny Lam, head of research at CEB International Investment Corp. in Hong Kong, referring to the inclusion of mainland Chinese stocks in index compiler MSCI’s gauges last month.

Happy Hour

Foreign investors hold biggest stake in Moutai in at least 15 months

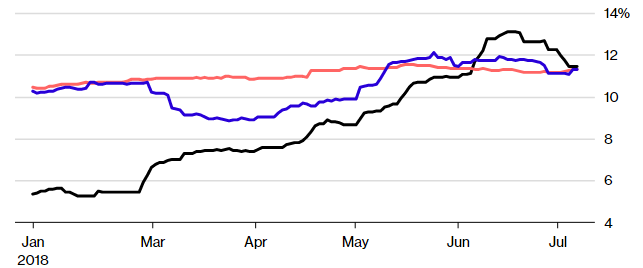

A New Favorite

Shenzhen-listed Han’s Laser is rapidly turning into one of the most popular stocks in the eyes of foreign investors, who have boosted their stake to more than 11 percent from just 5 percent in January. That’s the biggest increase for any company listed in Shenzhen. The maker of laser-based products has attracted investors because of the potential for Chinese industry to use more laser technology, said Hiroki Lu, a fund manager at SinoPac Securities Investment Trust in Taipei.

“Foreign investors initially invested in home appliances and liquor,” Lu said. “After the MSCI inclusion, they researched China more broadly and began to notice smaller companies — there is still a lot of potential for Han’s Laser to grow.”