Francophone West Africa leads in intra-regional trade with trade hotspots around Dakar, Abidjan, Cotonou and Lomé, according to analysis by Ecobank’s research team in its new website, AfricaFICC.

The team has updated Ecobank’s flagship Africa Fixed Income, Currency and Commodities Guidebook (FICC) and made it available as an online resource. The website provides key facts for businesses and investors on the economies of Sub-Saharan Africa and the key sectors of activity.

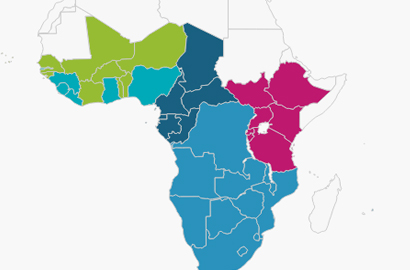

The first regional section of the website to go live is Francophone West Africa, one of the most diverse regions of Sub-Saharan Africa. Stretching from Senegal and Cape Verde in the West to Niger 2,000 miles away in the East, Francophone West Africa covers nine countries: Benin, Burkina Faso, Côte d’Ivoire (https://goo.gl/wq4F8f), Cape Verde, Guinea-Bissau, Mali, Niger, Senegal and Togo. Together they make up the Union Economique et Monétaire Ouest-Africaine (UEMOA). The website gives a country-by-country analysis of each country, with an economic outlook, details on the FX, FI and banking sectors, and overview of the mineral, energy and soft commodity sectors, as well as key trade flows.

Data for Francophone West Africa shows that, despite geographical differences, the region is one of the best integrated economic and monetary zones in Africa, bolstered by the shared currency (the CFA franc), the common legal system (OHADA) and the French language which has fostered economic integration and intra-regional trade.

Key factors to consider include:

The region’s economy is driven by agriculture, mining, hydrocarbons, trade and financial services, and is home to the world’s largest producer of cocoa (Côte d’Ivoire) and Africa’s largest regional producers of cotton and palm oil.

Abidjan, Dakar, Cotonou and Lomé are key trade hubs for trade, acting as conduits for the import and export of goods and services, both to the international market and to sub-regional markets.

Côte d’Ivoire and Senegal account for more than half the block’s GDP and trade flows, acting as vital lifelines for their landlocked neighbours, Burkina Faso, Mali and Niger. Benin and Togo are also major re-export hubs for capital & consumer goods and food, with large informal volumes not being captured by official data.

Côte d’Ivoire has the largest banking sector in UEMOA, followed by Senegal. Both countries are emerging as the key Fintech innovation hubs in Francophone Africa.

“Many businesses and investors struggle to find good and reliable economic data about Sub-Saharan Africa,” said Dr. Edward George, Ecobank’s Head of Group Research.

“Our new Africa FICC website offers a one-stop shop, with all the key economic, currency, banking, commodity and trade data that those working or investing in Sub-Saharan Africa need at their fingertips,” he said.

“Ecobank understands regional and local business customs, regulations and country-specific risks better than any other bank in Africa because we operate on the ground in 33 markets. This data will help us and our clients in making investment and other financial decisions as part of our seamless service,” said Charles Daboiko, Group Head for Francophone West Africa.

Country guides for the other regions of Sub-Saharan Africa – Anglophone West Africa, Central Africa, East Africa & Southern Africa – will go live over the coming month.

Country guides from other regions of sub-Saharan Africa – English-speaking West Africa, Central Africa, Eastern Africa and Southern Africa – will be posted online in the coming months.

Source: BIZTECH AFRICA