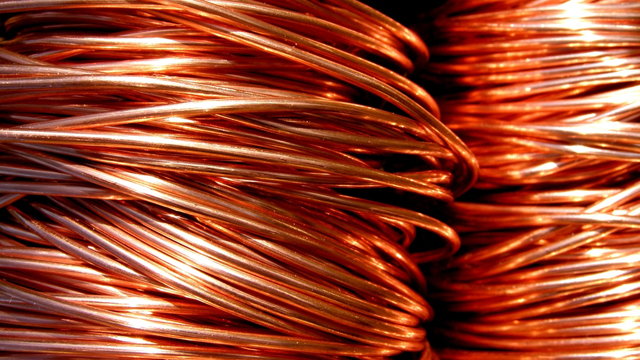

Copper surged more than 1 percent on Wednesday, January 31, and base metals rallied across the board as the dollar fell before the release of a Federal Reserve policy statement.

The red metal used in construction shrugged off slightly softer than expected Chinese manufacturing data as the weaker dollar made assets priced in the U.S. unit cheaper for holders of other currencies.

However, with speculators cutting their net long positions in copper futures and options, copper may have further to retrace, having fallen 1.5 percent so far this month after December’s rally to a near four-year high, analysts said.

“We see most of the flows in recent weeks following the dollar, and broader reflation trading and asset reallocation,” ING commodities strategist Oliver Nugent said.

“We do think prices remain too high compared to their fundamental justification, and if the (investment) flows keep behaving as they have, with positioning drawing out, we would expect a trend down in prices.”

London Metal Exchange copper was up 1.1 percent at $7,125 a tonne at 1515 GMT. Prices fell 0.5 percent in the previous session, touching their lowest in nearly a week at $6,994.LME nickel led gains across base metals, up 1.3 percent at $13,520 a tonne.

LME zinc was up 0.9 percent at $3,528 a tonne, while lead was up 1.1 percent at $2,620 and aluminium rose 0.2 percent to $2,212. Tin was up 0.7 percent at $21,775.

LME tin has surged almost 9 percent in the month to date, while metals affected by China’s winter pollution crackdown also rallied. LME zinc and nickel were up more than 6 percent while lead rose more than 5 percent, Reuters reports.