Zichis Agro Allied Industries Plc made a strong debut on the Nigerian Exchange (NGX) on Tuesday, 20 January 2026, closing its first day of trading with a near-10% gain following its official listing on the NGX Growth Board.

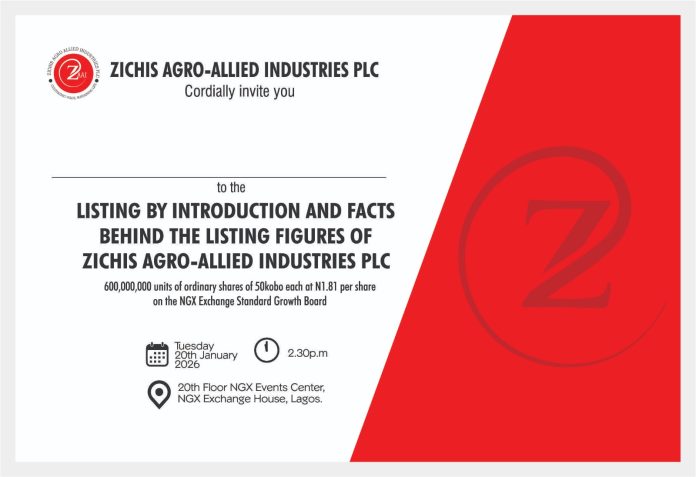

The agro-allied firm entered the market with 69.6 million ordinary shares listed, opening at ₦1.81 per share. The listing marks a key milestone for the company as it seeks to leverage capital market funding to support long-term expansion and operational growth.

Investor interest in the stock was evident throughout the trading session. Zichis Agro’s share price climbed steadily to close at ₦1.99, representing an absolute gain of ₦0.18 and a 9.94% appreciation on its first day.

The closing price remained comfortably above the day’s low limit of ₦1.63, signalling strong early demand and positive sentiment from investors evaluating the company’s prospects within Nigeria’s agricultural sector.

Market watchers say the stock’s performance reflects confidence in Zichis Agro’s diversified agribusiness operations, which span piggery, fishery and aquaculture, livestock breeding and husbandry, goat and cattle farming, snail farming, rice and maize intercropping, palm oil estate cultivation, and animal feed processing.

As a newly listed Growth Board company, Zichis Agro is well-positioned to benefit from Nigeria’s increasing focus on food security, agribusiness value-chain integration, and export-oriented agricultural production. These structural trends are expected to support the company’s long-term strategic objectives.

For investors, the strong debut suggests solid market acceptance and short-term momentum. Analysts note that long-term investors with a moderate risk profile may consider accumulating the stock on potential price pullbacks, given its exposure to the agro-allied sector and growth-focused business model.

Short-term traders are likely to keep a close watch on liquidity levels and price stability in the sessions ahead, following the sharp first-day rally.

While the company’s market entry has been met with optimism, analysts stress that consistent execution of its expansion strategy and earnings growth will be critical in shaping Zichis Agro Allied Industries Plc’s medium- to long-term valuation on the NGX.