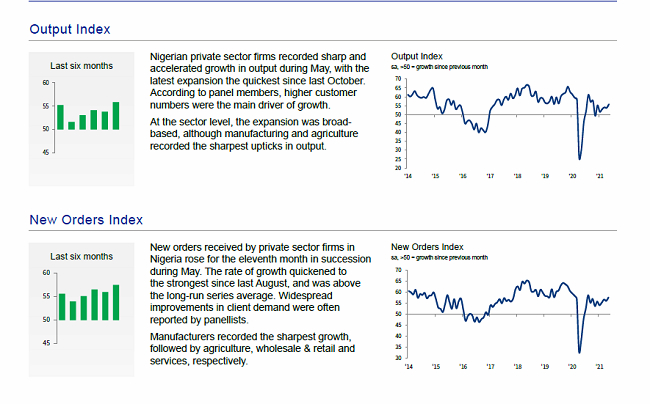

Growth in the Nigerian private sector gained momentum in May, with business conditions improving to the greatest extent in nine months. Output and new order growth strengthened, with companies reporting marked rises in customer numbers.

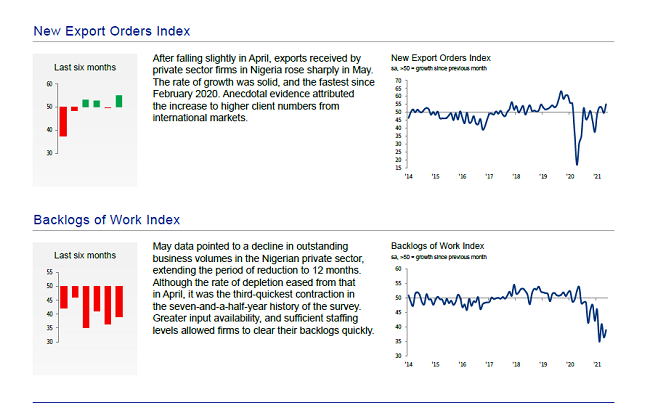

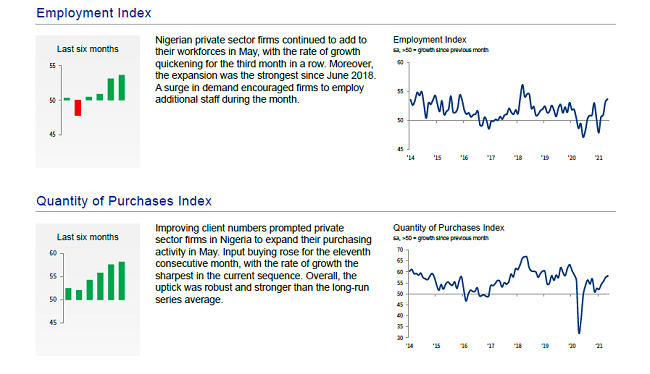

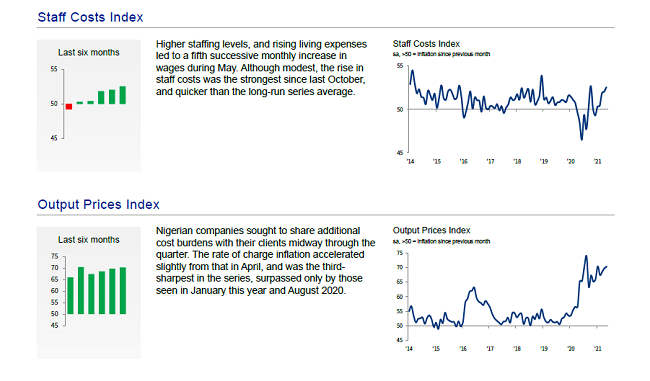

As a result, firms added to their headcounts, and at the strongest rate in almost three years. In response to greater output requirements, firms increased their buying activity and raised inventory holdings for the eleventh month of running.

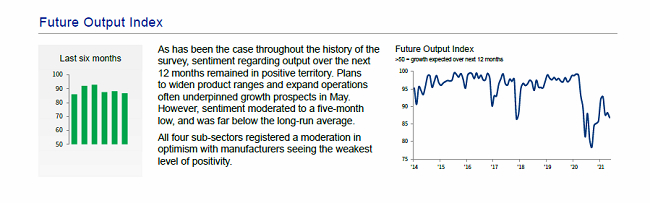

Plans to expand product offerings underpinned expectations for growth over the next 12 months, although sentiment moderated to a five-month low.

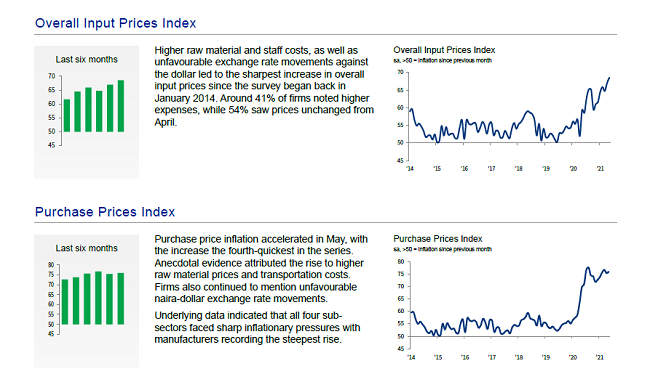

Meanwhile, overall input price inflation quickened to the sharpest in the series history. Rising staff and material costs were behind higher prices.

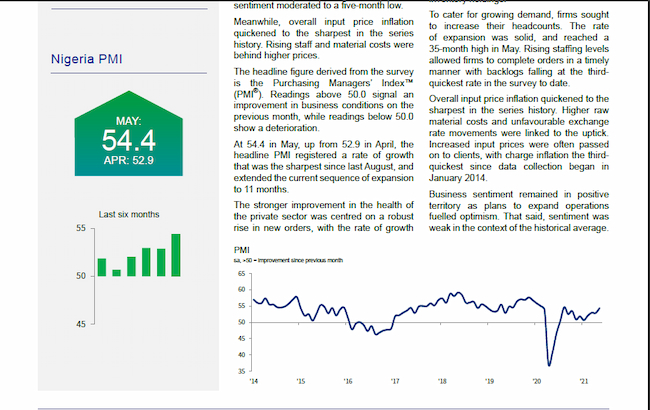

The headline figure derived from the survey is the Purchasing Managers’ Index™ (PMI®). Readings above 50.0 signal an improvement in business conditions on the previous month, while readings below 50.0 show a deterioration.

READ ALSO: FG To Explore Gold Mining Opportunities

At 54.4 in May, up from 52.9 in April, the headline PMI registered a rate of growth that was the sharpest since last August, and extended the current sequence of expansion to 11 months.

The stronger improvement in the health of the private sector was centred on a robust rise in new orders, with the rate of growth the strongest since last August. Exports meanwhile rose at the fastest pace since February 2020.

With new business up sharply, firms increased output levels for the sixth month in succession. The latest uptick was the strongest in the aforementioned sequence and in line with the series average.

Subsector PMI readings indicated manufacturers saw the fastest rise, followed by agriculture, services and wholesale & retail, respectively. Meanwhile, larger output requirements encouraged increases in buying activity and inventory holdings.

To cater for growing demand, firms sought to increase their headcounts. The rate of expansion was solid, and reached a 35-month high in May. Rising staffing levels allowed firms to complete orders in a timely manner with backlogs falling at the thirdquickest rate in the survey to date.

Overall input price inflation quickened to the sharpest in the series history. Higher raw material costs and unfavourable exchange rate movements were linked to the uptick.

Increased input prices were often passed on to clients, with charge inflation the third quickest since data collection began in January 2014.

Business sentiment remained in positive territory as plans to expand operations fuelled optimism. That said, the sentiment was weak in the context of the historical average.