In Nigeria’s challenging economic environment, healthcare—particularly pharmaceuticals—remains one of the few sectors insulated from discretionary spending cycles. Medicines are consumed regardless of economic conditions, making pharmaceutical demand structurally resilient across booms and downturns.

From antimalarials and antibiotics to chronic-care and over-the-counter drugs, consumption persists even as household incomes come under pressure. This reality positions pharmaceutical equities as both defensive assets and growth vehicles on the Nigerian Exchange (NGX) heading into 2026.

Against this backdrop, investor attention is increasingly focused on four listed names: Fidson Healthcare, May & Baker Nigeria, Neimeth International Pharmaceuticals, and MeCure Industries. Each company presents a distinct blend of scale, growth trajectory, profitability, and financial risk.

Sector Anchored by Inelastic Demand

Collectively, these companies represent a sector underpinned by unavoidable consumption, expanding local manufacturing capacity, and improving operational performance. Unlike speculative themes, the pharmaceutical investment case rests on tangible products, recurring demand, and cash-generating businesses.

As 2026 approaches, pharmaceutical stocks are increasingly viewed as plays on earnings execution rather than sentiment, in a market where real consumption matters more than narratives.

Fidson Healthcare Plc: Sector Bellwether

Fidson remains the undisputed leader among NGX-listed pharmaceutical firms. Between 2024 and 2025, the company delivered robust operational growth, with revenue rising from approximately ₦53.1 billion to ₦84.2 billion, while net profit expanded sharply on the back of manufacturing efficiency and scale advantages.

Earnings per share increased materially, enabling higher dividend payouts. Fidson’s WHO-compliant production facilities and nationwide distribution network continue to underpin its competitive edge.

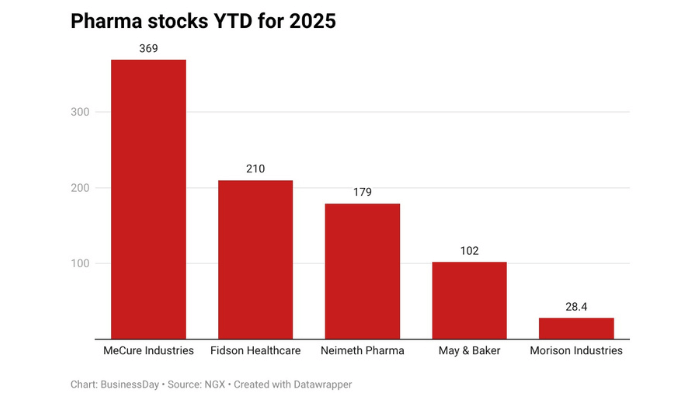

In the equity market, Fidson’s stock outperformed both sector peers and the broader NGX All-Share Index, posting year-to-date gains exceeding 150 per cent in 2025.

2026 Investment Case:

- Largest listed pharmaceutical manufacturer by scale

- Strong profitability and consistent dividend history

- Relatively sound balance sheet with manageable leverage

Positioning: Core long-term holding for investors seeking growth supported by real earnings and market leadership.

May & Baker Nigeria Plc: Stability and Efficiency

May & Baker combines brand recognition with improving financial fundamentals. In 2025, the stock delivered strong equity returns, supported by expanding sales volumes and a growing asset base.

For the nine months ended September 2025, revenue reached approximately ₦29.5 billion, while pre-tax profit nearly doubled year-on-year, reflecting resilient demand and improving cost efficiency.

Unlike Fidson’s scale-driven dominance, May & Baker appeals through consistent execution, stable profitability, and its diversified product mix spanning prescription drugs, vaccines, and consumer healthcare.

2026 Investment Case:

- Predictable revenue and earnings growth

- Profitable operations with improving retained earnings

- Smaller scale may limit outsized rallies

Positioning: A solid mid-tier pharmaceutical exposure for investors balancing stability with moderate growth.

Neimeth International Pharmaceuticals: Turnaround Play

Neimeth’s 2025 equity performance drew attention, with shares rising by more than 130 per cent year-to-date, driven largely by re-rating expectations and revenue improvement.

While top-line growth has strengthened, profitability remains modest compared with larger peers, reflecting higher finance costs and limited operational scale.

2026 Investment Case:

- Market pricing anticipates earnings stabilisation

- Diversified OTC and niche products support revenue base

- Thin margins and leverage elevate risk

Positioning: Speculative value opportunity suited to investors comfortable with turnaround risk.

MeCure Industries: High-Growth Outlier

MeCure stands out as the fastest-growing revenue story in the group. In 2025, revenue nearly doubled year-on-year, while profit expanded sharply, driven by strong demand across acute and OTC product lines.

Pre-tax profit exceeded ₦13 billion for the nine-month period, though dividend payouts remain modest. The company’s capital structure carries relatively higher leverage, increasing sensitivity to financing costs.

2026 Investment Case:

- Exceptional revenue momentum

- Operating leverage supporting margin expansion

- Higher volatility due to leverage and growth pace

Positioning: High-risk, high-reward growth stock for investors targeting outperformance.

Outlook for 2026

Pharmaceutical consumption in Nigeria is not cyclical—it is essential. Population growth, rising chronic disease incidence, and persistent public health needs ensure sustained demand for locally manufactured medicines.

Even amid inflation and currency volatility, pharmaceutical spending remains resilient, differentiating the sector from discretionary consumer and industrial plays. As a result, 2026 is likely to reward companies that deliver consistent earnings, disciplined execution, and demand certainty.