- The United Arab Emirates has seen a boom in the number of local mobile payments services on offer for consumers over the past two years, with platforms rushing to capitalize on the growing popularity of digital payments and attract the country’s 1.3 million unbanked adult residents.

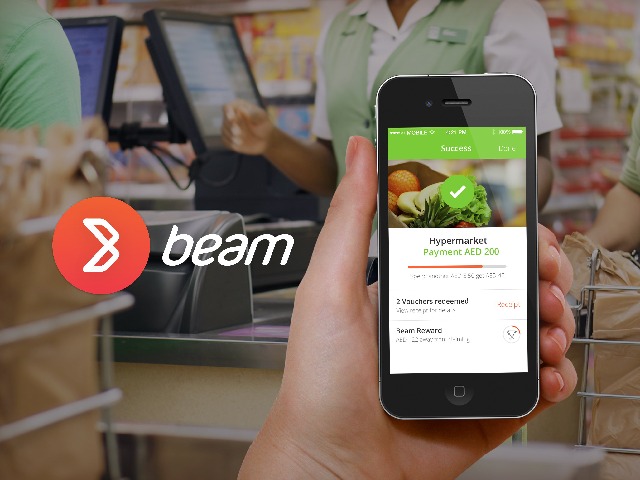

- Beam attempts to differentiate its offering by providing users a hyper-local experience, and offering loyalty rewards, cashback programs and incentives within its ecosystem.

Dubai-based mobile payments platform Beam will expand into seven new markets next year, seeking international growth in the increasingly competitive and fragmented payments sector.

“Now we’ve demonstrated and proven value for both the consumer and for the merchant, it’s about taking to the next level and opening up into new markets,” Beam co-founder Shezan Amiji told CNBC’s “Capital Connection” on Wednesday.

The firm already has a foothold in Australia and Sweden.

“There has not been a strategic direction in terms of this market or that market — these are discussions that people have come to us and said, we’re interested in what you have done and why can’t we work together,” Amiji said.

The rush to aggressively expand overseas comes after Beam’s UAE operations were acquired by Majid Al Futtaim, one of the largest privately held brick and mortar retail conglomerates in the region.

The company, founded by an Emirati of the same name, operates hotels, retail outlets and malls. It also holds the exclusive rights to the Carrefoursupermarket franchise in 38 markets across Middle East, Africa and Asia.

“The value proposition for them is about trying to understand consumer behavior better,” Amiji said. “The data i think is the richness for them, and also having a direct relationship with the consumer.”

The terms weren’t disclosed, but the acquisition gave Majid Al Futtaim ownership of Beam’s IP rights, branding, and e-wallet services, in a bold digital play to acquire and retain customers. It now plans to roll out the digital payments offering across its retail stores in 2019.

The United Arab Emirates has seen a boom in the number of local mobile payments services on offer for consumers over the past two years, with platforms rushing to capitalize on the growing popularity of digital payments and attract the country’s 1.3 million unbanked adult residents.

Mobile operator Etisalat, along with local bank, Emirates NBD, both launched mobile wallet offerings in 2016. Apple Pay, Samsung Pay, and more recently, Google Pay are all now available in the country.

A consortium of 16 banks in the UAE are also joining forces to create the Emirates Digital Wallet — known as Klip — which aims to further enable the cashless economy and support the UAE central bank aim of reducing and ultimately eliminating the circulation of cash to minimize financial risk and fraud.

Beam attempts to differentiate its offering by providing users a hyper-local experience, and offering loyalty rewards, cashback programs and incentives within its ecosystem.

“Mobile payments solutions are trying to solve a problem that doesn’t exist today. You need to offer the consumer and the merchant something that they can’t get,” Amiji said.

“The value proposition of convenience is too narrow to shift consumer behavior at scale, so you need to have value in the system in order to incentivize change and drive adoption at scale,” he added.