By Kindness Udoh

If you’re active on social media, you may have come across the viral appeal that is this newsletter’s headline. In case you weren’t informed, the recent occupant of Aso Rock, Bola Ahmed Tinubu, while addressing journalists, made an emphatic call to, “Let the poor breeef”.

The power of social media has enabled the quick adoption of that statement into the everyday lingo of many Nigerians, irrespective of the context. This reminds me of the election season, back-to-back hit statements.

Remember “is it for agbado?”?

Anyway…

That video was recorded on May 29, 2023, the day Tinubu swore his oath as president. He was on a tour of his new crib, Aso Rock. His tour guide? Sai Baba, Mr. Buhari. If you look past the political poker face he had on, Tinubu was basically entreating the political elites to take their legs and knees off the necks of Nigerians.

Where are those knees now?

Still on the necks of Nigerians. The pressure only intensified merely a day after that the call to “let the poor breeef” was issued. On inauguration day, Tinubu declared, “Fuel subsidy is gone”. That kicked-off the oxygen-choking exercise. Fuel price skyrocketed. And as the norm, water leaf saw an increase in price because “fuel don cost”.

In Tinubu’s defense, here’s his justification for doing so, “We shall instead re-channel the funds into better investment in public infrastructure, education, healthcare and jobs that will materially improve the lives of millions.”

Not bad at all, because for a long time, the previous governments have made moves to cancel the sham that is fuel subsidization, but as it is with governance in Nigeria, the greediest prevails. However, the gripe with the removal is the manner in which it was done, especially seeing as it came at a very high cost, not to the government (God knows the three arms know no cost) but to the people.

Don’t suffocate the poor

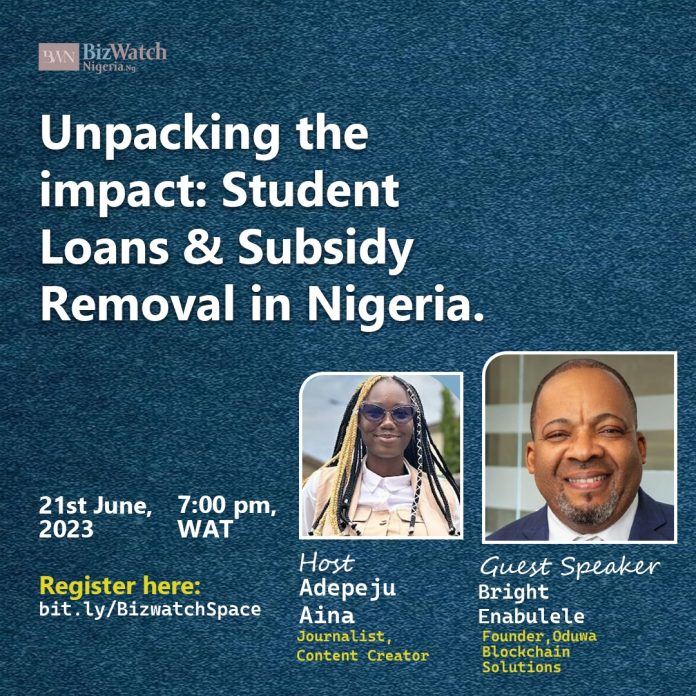

It didn’t end there. The incumbent administration signed off another policy that would deliver another blow to the oxygen supply of Nigerians: The Students’ Loan Act. While some praised the initiative, many have described it as ill-conceived and have asked for a review of the policy or even discard it altogether.

With that policy, many poor Nigerians who couldn’t afford the luxury of education on a subsidized education system will now kiss the opportunity to that access goodbye. The requirements to access the loan is enough to render a lot of applicants ineligible. Here’s the argument of a civil society group – Education Rights Campaign (ERC):

“By virtue of the Minimum Wage Act 2019, the lowest paid worker in Nigeria is meant to take home nothing less than N30,000 per month. Now if you divide N500,000 by 12 calendar months, it will give you N42,000 as the maximum income the family of a beneficiary must have.

“By saying family, it is logically inferable that the Act means the salary of not one but both parents. Therefore by virtue of the Minimum Wage Act, the lowest family income of two parents should be nothing less than N60,000 on a monthly basis which would be N720,000 per annum – an amount that is far above the threshold contemplated in the Act.

“What this means is that the children of the lowest-paid worker will not be able to access this loan. If low-paid workers do not qualify as poor in the wisdom of the drafters of this legislation then who exactly is poor in this country? What rationale did the drafters of this legislation use in determining the criteria for qualification?”

The pressure is getting wesser

While still recovering from the news of the Student Loan Act, Nigerians received another news of salary increase for Tinubu, his vice, Shettima, governors, judges, and other political office holders by 114 percent.

Although not outrightly debunked by Tinubu, the presidency (in Nigeria, president and presidency are seemingly two different bodies) has said that the news is untrue. In this country, has there ever been a rumor that has no truth in it?

Nigerians, are you still breeefing?

“God bless PD…APC”.