The Bill seeks to promote fiscal equity, align domestic laws with global best practices and support Micro, Small and Medium-sized businesses. Other objectives include increasing government revenues and stakeholder investments in the investment/capital market through the introduction of incentives.

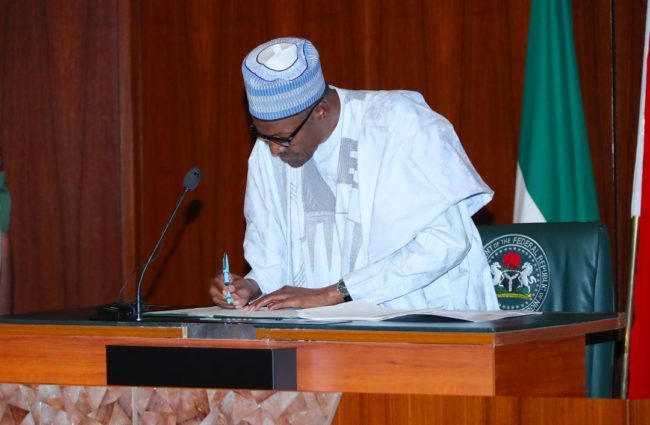

The Finance Bill, 2019 (the Bill), presented alongside the 2020 Appropriation Bill to a joint session of the National Assembly on October 8, 2019, by President Muhammadu Buhari, has been passed by the Senate. Submission of a “finance bill” or fiscal legislation with the budget/Appropriation Bill is not new in Nigeria as past military regimes had, during budget pronouncements, amended various tax laws.

The Bill is an omnibus draft legislation, aimed at curing the deficiencies of major primary tax legislation by amending obsolete and contentious provisions. This is a major aspect of the initiatives suggested by the President Enabling Business Environment Council (PEBEC)1 and the National Tax Policy Implementation Committee.

This newsletter gives an overview of the Bill, analyses the key provisions vis-à-vis the changes to the primary taxing legislation, and highlights the potential tax implications for stakeholders. Other areas covered by this newsletter include implementation challenges, transitional arrangements and required actions by stakeholders.

See full ew finance law analysis by Deloitte: ng-deloitte-newsletter-nigerias-finance-bill 2019