Nigeria’s debt servicing since 2015 has gulped at least N14 trillion. This is according to the Budget Office.

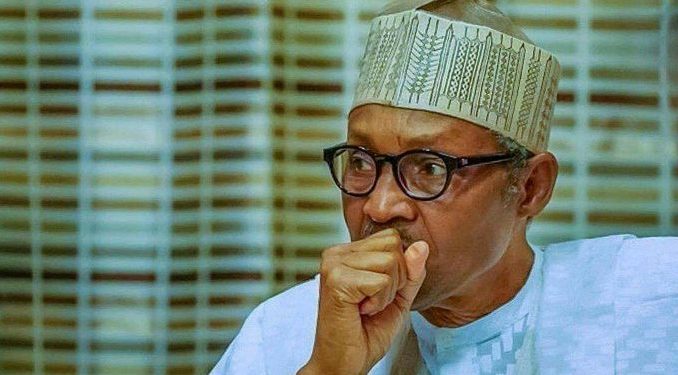

In a recently-published data cited by BizWatch Nigeria, the Budget Office disclosed that the President Muhammadu Buhari’s government so far has spent a total of N14.13 trillion servicing the domestic and foreign debts of the country.

The report, which covers between 2015 and 2022, also revealed that no less than N30.58 trillion has been recorded as Nigeria’s budget deficit. Hence, while the Buhari-led administration has spent N54.98 trillion on budget implementation since its inception, it has only been able to finance this spending with N24.39 trillion, leaving a deficit of N30.58 trillion.

As read in the data, a breakdown of some of the expenses has it that the government spent at least N23.66 trillion on personnel costs, pensions, overhead costs, presidential amnesty programme, other service-wide votes, and special interventions.

Explaining the situation, the Budget Office stated that the deficit has been largely financed by borrowings.

“The FGN has arranged to raise short-term credit from the CBN through the mechanism of Ways and Means subject to a ceiling of 12.5% of FGN’s revenue. This amount will be retired and therefore not considered as new borrowing outside the borrowing approved to finance the budget deficit. However, due to current fiscal challenges, the CBN had agreed to increase the Ways and Means advances threshold hence the FGN’s ability to raise N615.96bn from this source,” the report read.

Expert’s opinion on Nigeria’s debt

Reacting to how the government is financing its budget deficit with debt, Professor Akpan Ekpo, a seasoned academic at the University of Uyo (UNIUYO), lamented that Nigeria is spending more than it earns, which is problematic for the economy.

“This shows that expenditure has eclipsed the revenue, because they have to borrow, which is why there is a deficit.

“They can’t raise enough domestic resources to finance spending. That gap is the deficit. Talking about GDP, by the rules, it should not be more than a certain percentage of GDP, but it has exceeded that. And when you borrow, you have expectations of borrowing because if you are not transparent, we don’t know what you are borrowing for. We are spending more than we can raise resources and we are not spending it on hard infrastructure,” he explained.