Nigerian stocks rose 3.7 percent yesterday to their highest level in more than 16 months after investors swooped on banking and consumer goods companies’ counters.

The stock has maintained a bullish trend since the beginning of the week following increased buying interests that have greeted the influx of mixed corporate numbers.

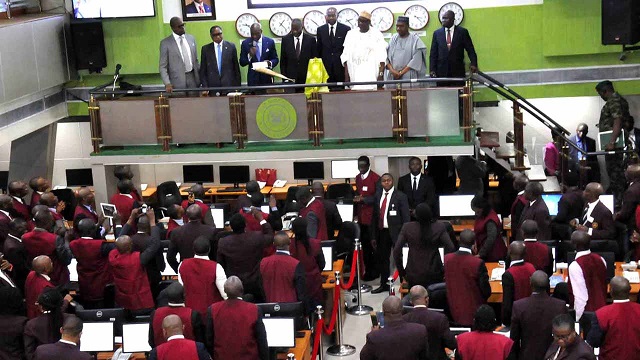

The number of better-than-expected results lifted demand to a peak, driving the Nigerian Stock Exchange (NSE) All-Share Index to cross the 30,000 mark to close at 30,530.69. Also, market capitalisation hit N15.958 trillion, while volume and value of trading soared by 115 per cent and 127 per cent 807.810 million shares and N10.501 billion respectively.

Although some level of apprehension was expressed following the unrest last week after hoodlums hijacked the #EndSARS protests, most analysts and market operators had remained upbeat about the market.

Analysts at Cordros Research, for instance, said despite the heat in the socio-political landscape triggered by the degeneration of the #EndSARS protests, they did not expect a material dent to investors’ appetite for stocks.

“We reiterate that pent up system liquidity and the hunt for alpha-yielding opportunities in the face of increasingly negative real returns in the fixed income market remain positive for stocks. However, we advise investors to trade in only fundamentally justified stocks as the weak macro environment remains a significant headwind for corporate earnings,” analysts at Cordros Research said.

The stock market has remained investors’ bride since the real returns in the fixed income market turned negative and increased liquidity in the system.

While making a case for buying interest in the equities market, Analysts at Meristem Research had said they identified elevated system liquidity supported by incoming Open Market Operations (OMO) maturities, depressed fixed income yields and a dearth of attractive alternative investment options.

The Chief Executive Officer of the NSE, Mr. Oscar Onyema, had linked the stock market rally to CBN’s restriction of domestic investors from participating in its open market operations (OMO) as well as the interest rate cut.

According to Onyema, investors are always in search of higher returns on investments, noting that central bank’s policies have made the stock market attractive to investors.

He said: “I must say that some of the policy changes I made reference to include the CBN policy that domestic institutional investors should stop participating in the OMO market. That has driven significant funds into the Nigerian Treasury Bills (NTB) market and some of those funds have found their way into the equities market. We have also seen a cut in interest rate. That was a significant move in support of equities as an asset class. What investors tend to do is to look for yield.”

NSE CEO said since the Nigerian economy has shifted into a negative real interest rate environment, investors are now in search of investments that would give them higher yields and returns.

“Given the record dividend yield available in the Nigerian market and given the strong fundamentals of a number of companies that are listed on the Exchange, it makes sense that as investors try to rebalance their portfolio, they would look at equities,” he said.

Source: THISDAY