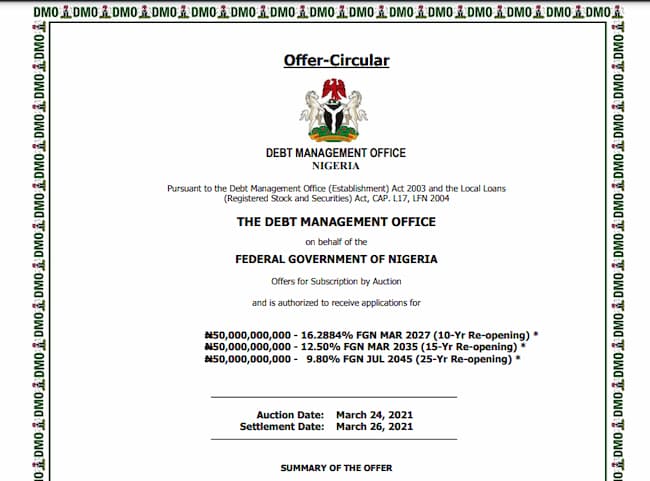

The Nigerian Government is set to offer N150 billion bonds for subscription this month.

A circular released by Debt Management Officer (DMO) on Wednesday showed that the breakdown of bonds comprised of three bonds valued at N50 billion each.

The bonds, which would be auctioned on March 24, have a settlement date of March 26.

They are 10-year reopening bond to be offered at the rate of 16.888 per cent and to mature in March 2027; a 15- year reopening bond to be offered at 12.5 per cent and mature in March 2035; and the third and longest bond which is a 25-year reopening bond to be offered at 9.8 per cent and mature in July 2045.

The DMO had earlier disclosed that the Federal Government’s bonds for February worth N150bn were oversubscribed by N39.51billion.

READ ALSO: Nigeria Among Top 20 Countries Known For Internet Crimes – FBI

The total subscription received from investors for the bonds was N189.51bn, comprising of N77.05billion for 16.2884 per cent FGN March 2027 bonds; N72.33billion for 12.5 per cent FGN March 2035 bonds; and N40.13billion for 9.8 per cent GFN July 2045 bonds.

The auction result showed that out of the 78, 53 and 60 total bids for the tenures, 31, 20 and 30 bids were successful.

The DMO stated that a total of N80.55billion was allotted comprising of N33.62billion, N28.9billion and N18.03billion.

It said, “Successful bids for the 16.2884 per cent FGN March 2027, 12.5 per cent FGN March 2035 and 9.8 per cent FGN July 2045 were allotted at the marginal rates of 10.25 per cent, 11.25 per cent and 11.8 per cent respectively.

“However, the original coupon rates of 16.2884 per cent for the 16.2884 per cent FGN March 2027, 12.5 per cent for the 12.5 per cent FGN March 2035 and 9.8 per cent for the 9.8 per cent FGN July 2045 will be maintained.”