Following a N1 trillion loss in the stock market in April, the Nigerian Exchange (NGX) opened negative in May 2023 due to early exit transactions conducted by sell-side investors.

Despite earnings releases by listed companies on the Lagos bourse, equities market capitalisation fell by about N57 billion in total. Today’s trading performance ended a seven-day bullish streak, thus key performance indicators fell, and stockbrokers urged investors to focus on value and growth counters.

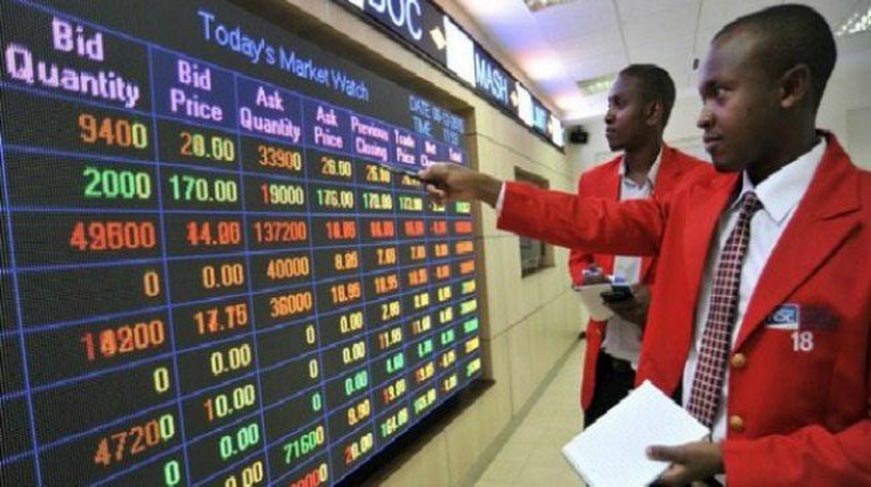

According to data, the year-to-date return has decreased to 2.05% following a fall in the NGX All-Share Index. As a result, the NGX ASI closed at 52,296.48 points. According to trading statistics, market activity was down today, with the total volume and total value traded down by -82.41% and -60.59%, respectively.

Atlass Portfolios Ltd stockbrokers said that in 6,250 transactions, roughly 550.29 million units valued at $5,150.49 million were exchanged. ACCESSCORP was the most traded stock by volume, accounting for 35.87% of total transaction activity.

MANSARD (10.01%), WAPIC (6.95%), FIDELITYBK (4.80%), and UBA (4.36%) rounded out the top five on the volume ranking. Similarly, ACCESSCORP was the most traded stock in terms of value, accounting for 33.12% of all trades on the market.

CONOIL and UBN lead the advancers’ list with a 10% price increase, followed by MULTIVERSE (9.71%), NAHCO (9.62%), NB (+9.38%), WEMABANK (+7.89%), and twenty-four others.

Thirty companies fell in price, with GEREGU leading the way with a -10.00% drop to close at 290.7, followed by TRANSCORP (-9.96%), AFRIPRUD (-9.40%), INTBREW (-8.51%), and IKEJAJHOTEL (-6.85%).

According to the NGX data, the market breadth concluded positive, with 30 gainers and 24 losers. Nonetheless, four of the five major market sectors closed positive, led by the Banking sector (+2.84%), followed by the Insurance sector (+1.25%), the Oil & Gas sector (+1.05%), and the Consumer goods sector (+0.31%).

The Industrial sector fell -0.08%. Overall, stocks market capitalization fell 56.78 billion, or +0.20%, to end at 28,477.12 trillion, down from 28,533.90 trillion last Friday.