The Monetary Policy Committee of the Central Bank of Nigeria (CBN) on Tuesday unanimously voted to retained the monetary policy rate (MPR), which determines interest rate, at 11.5 percent.

This was as the MPC concluded its two-day policy meeting, the last for the year 2020.

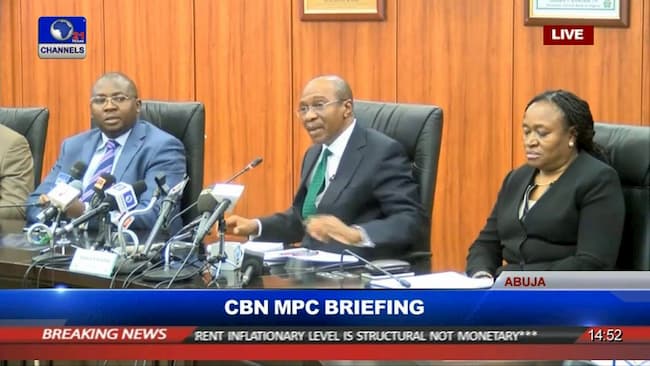

Godwin Emefiele, the CBN governor, announced the committee’s decision at the end of its two-day meeting saying the committee resolved to hold the monetary policy rate and all other policy parameters constant.

The committee also retained the Liquidity Ratio at 30 percent and Cash Reserve Ratio (CRR) at 27.5 percent. This according to the CBN “will allow current policy measures to permeate the economy”.

READ ALSO: 5 Ways To Grow Your Business Using E-Channels

Emefiele expressed cautious optimism that Nigeria will exit recession in first quarter (Q1) of 2021 based on effort made by CBN and the fiscal authorities to create jobs and stimulate growth.

He, however, warned speculators against creating panic in the Nigerian foreign exchange market, insisting that the parallel market should not be the basis for determining the value of the Naira.

The governor said CBN will attack inflation from the supply side through low interest rates, reiterating the need to diversify Nigeria’s economy to grow its foreign revenue base. He noted the impact of structural policies such as increase in petrol price and electricity tariff on inflation.