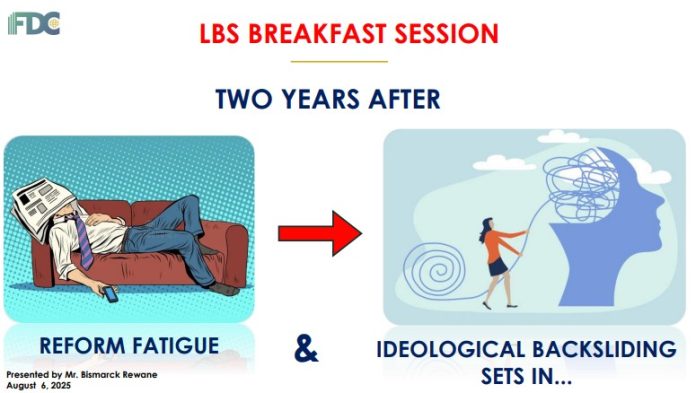

When Bismarck Rewane took the stage at the Lagos Business School (LBS) Breakfast Session of August 2025, his message was as sobering as it was forward-looking. Two years into Nigeria’s bold economic reforms—subsidy removal, naira floatation, and privatization—reality is setting in: reform fatigue, ideological backsliding, and misallocation of scarce resources threaten to undermine progress. For business leaders and investors, the lessons from his presentation are both cautionary and instructive.

🔗 Download the full LBS Breakfast Presentation (August 2025)

Reform Fatigue and Its Economic Tol

Economic reforms often begin with optimism. Yet, as Rewane highlighted, history shows that two years after implementation, fatigue sets in. Just as Thatcher’s UK, Myanmar, and Moldova saw their bold policies spark unintended hardships, Nigeria today faces a similar challenge: rising inflation, currency volatility, and eroding disposable income.

While subsidy removal has boosted government revenue, households and businesses continue to feel the squeeze. Inflation eased marginally to 22.22% in June 2025, but food prices remain stubbornly high. For entrepreneurs, this environment demands careful cost management and strategic pricing to stay competitive without alienating consumers.

Aviation: A Bottomless Pit or a Catalyst?

One of the sharpest insights from the session was Nigeria’s obsession with aviation. Over the past eight years, multiple states have plunged into building airports and even launching airlines—Ibom Air, Cally Air, and the newly announced Enugu Air—despite the sector’s notoriously slim margins.

Globally, airlines average a razor-thin 2.5% profit margin, with African carriers faring worse at just 0.6% in 2024. Meanwhile, African airlines face double the operating costs of their global peers. Rewane cautioned that pouring billions of naira into airlines—an industry Warren Buffet once described as a “bottomless pit”—is a questionable use of scarce resources.

For business leaders, the takeaway is clear: states should rethink airline vanity projects and focus on infrastructure with broader impact—roads, schools, and healthcare—that catalyze real productivity and unlock consumer spending.

Privatization: The Telecommunication Lesson

Nigeria’s telecom sector is a case study in successful privatization. In 1999, NITEL managed just 400,000 telephone lines with a teledensity of 0.04%. Fast-forward to today, the industry boasts over 169 million active lines and 48% broadband penetration.

Contrast this with Nigeria’s petroleum downstream sector, which has only begun its transition to market-based pricing after years of inefficiency and corruption. For investors, the lesson is unmistakable: private-sector-led growth delivers efficiency, innovation, and profitability, while state-led enterprises often drown in bureaucracy and political interference.

Stock Market Signals: Resilience Amid Risks

One bright spot in Rewane’s outlook was the Nigerian Exchange (NGX). Despite high interest rates, FX volatility, and inflationary pressures, the NGX recorded a 36% year-to-date return in naira terms and 30% in dollar terms. This performance outpaced most African peers, positioning Nigeria as a surprisingly attractive equity market for both local and foreign investors.

However, risks remain. Valuations are climbing, with the NGX’s P/E ratio rising from 6.7x in 2024 to 7.8x in July 2025. While not yet bubble territory, Rewane warned that sustained overvaluation without earnings support could trigger a painful correction. For investors, this is a signal to balance optimism with discipline—rotate portfolios, hedge against naira risks, and prepare to buy the dip after inevitable corrections.

The Creative Economy: Nigeria’s New Growth Engin

Perhaps the most optimistic theme of the breakfast session was the creative industry’s rapid rise. Growing at 9.63% in Q1 2025, it has outpaced national GDP growth more than threefold. Music, film, fashion, and sports are now among Nigeria’s fastest-growing exports, with the sector projected to be worth $10–20 billion by 2027.

For investors, opportunities abound in content production, talent development, and digital distribution. The global media and entertainment industry is set to generate $3.5 trillion by 2029, and Nigeria, with its youthful population and digital connectivity, is positioned to capture a meaningful slice of that pie.

Policy Outlook: Stability, but Caution Ahead

Looking forward, Rewane projects moderate stability in key variables:

- Naira to trade between ₦1,500–₦1,600/$ through Q3 2025

- Inflation to decline gradually to 21.79% in July 2025

- Interest rates likely to ease slightly, with a 25bps cut signaling a slow shift toward cheaper credit

- Oil production improving, though still below budget benchmarks

Yet, he warned that Nigeria’s “suboptimal use of resources” is unsustainable. Spending ₦53 billion on a new airport, he noted, could alternatively build 424 primary healthcare centers or 350 secondary school blocks—a stark reminder of opportunity cost.

Bottom Line for Business Leader

The LBS Breakfast Session offered no illusions: Nigeria’s reform journey is far from over, and missteps could roll back hard-won gains. For business-minded Nigerians, the insights converge on three key strategies:

- Prioritize efficiency over expansion – Whether in aviation or manufacturing, focus on operations that deliver sustainable margins, not prestige.

- Follow privatization trends – Invest in sectors where government is stepping back, as telecoms and downstream oil show the private sector’s ability to unlock growth.

- Bet on the creative economy – Nigeria’s cultural exports are not just art—they’re billion-dollar opportunities waiting for capital, structure, and scale.

The reforms may be biting, but for disciplined investors, the next wave of growth opportunities is already visible.

🔗 Access the full LBS Breakfast Presentation (August 2025)