- Yobe, Anambra, Jigawa least indebted states

- Domestic debt service gulps N606bn in Q3

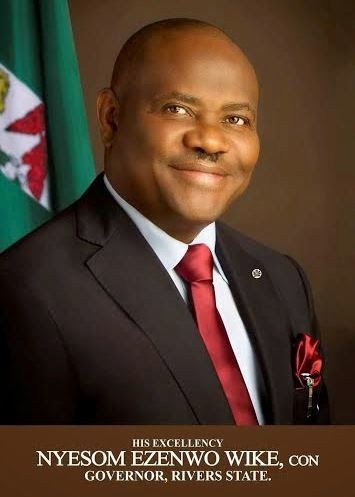

Lagos, Rivers, Akwa Ibom, Delta and Cross River States are the leading debtor-states in the country, according to the latest statistics obtained from the Debt Management Office (DMO).

Data from the DMO also showed that the federal government has spent N606.869 billion to service domestic debts in the third quarter of 2019.

Collectively, the leading debtor-states accounted for more than N1.344 trillion of the over N4 trillion domestic debt standing against the 36 states of the federation and the Federal Capital Territory (FCT) as at September 30, 2019, according to the statistics obtained from DMO website.

Lagos leads the top five with N441,668,732,162.26, Rivers is next with N266,936,225,793.65, while Akwa Ibom, Delta, and Cross River states follow on the debt scale with N237,404,479,750.88; N230,574,799,366.01 and N167,967,705,888.45 respectively.

Apart from the five, Imo (N148,900,627,563.76); Osun (N141,792,935,913.24); Ogun (N140,993,426,875.02); FCT (N137,862,316,926.60), Bayelsa (N127,243,132,172.38 and Kogi (N123,436,748,898.43) are other leading debtor-states.

On a geopolitical basis, the six South-south states lead with the highest aggregate debt of N1,113,311,886,960.1 followed by the South-west with N957,158,703,679.04.

Next on the geopolitical basis is the North-central (N510,790,349,558.25; North-west, which has the highest number of states in the country (seven) is next with N484, 867,921,659.82 followed by North-east and the five South-east states with N480,890217,532.59 and N357,513,205,096.01 respectively.

Yobe and Anambra States have the least debt burden. While Yobe’s debt stands at N28,533,478,934.83, that of Anambra is N34,007,803,458.86.

Nigeria’s total debt stock (local and foreign) as at September 30, 2019 was N26.2 trillion with the federal government accounting for over N9 trillion of the almost N14 trillion domestic debt stock.

Domestic Debt Service Gulps N606bn in Q3

Meanwhile, the federal government spent a total of N606.869 billion to service domestic debt in the third quarter of 2019, the DMO data revealed.

A breakdown indicates that in July, August and September, N202,538,970,831.25; N172,663,065,962.98 and N231,667,076,449.72 respectively went into domestic service.

They included interest paid on Federal Government of Nigeria Savings Bonds (FGNSB), Nigeria Treasury Bills (NTBs), FGN Sukuk, Federal Government Bonds and Treasury Bonds.

But government’s plan to ease pressure from domestic creditors through the use of Promissory Notes, which are sovereign debt instruments, may not be getting the desired result.

The Federal Executive Council (FEC) had in April last year approved a N3.4 trillion Promissory Note programme to settle local debts and contractual obligations of the federal government.

However, about nine months after FEC approval, THISDAY investigations revealed that the executive arm of government is yet to seek the endorsement of the Promissory Notes Programme from the National Assembly.

Promissory notes are only issued to creditors after approval by the National Assembly.

Some senators told THISDAY they were ignorant of any request from the executive to the legislature for the approval of N3.4 trillion to service local debts through the issuance of promissory notes.

A member of the Senate Committee on Local and Foreign Debts, who spoke off the record, stated that since the inauguration of the Ninth Senate last June, the executive was yet to send any such request to the upper chamber for approval.

The ranking senator, who spoke on condition of anonymity, stressed that it may be true that the Federal Executive Council (FEC) at one of its weekly meetings approved N3.4 trillion to service local debts through promissory note but that request was yet to be forwarded to the Senate.

According to him, it was one thing for FEC to give the nod but another ball game for the request to be forwarded to the Senate for approval, adding that there is no way the Senate would have such a request without recourse to its committee on local and foreign debts.

He said: “For all I know, only one request had been made in the last six months by the president for the financing of local debts through promissory note and that was the N10.06 billion promissory note as refund to Kogi State Government for federal roads executed on its behalf in the past.

“The executive request was read at plenary and forwarded to our committee for further legislative work at the end of which the committee on local and foreign debts recommended the approval of the N10.06 billion promissory note, which the Senate at plenary approved few days to the gubernatorial election in Kogi State last November.”

Efforts to get the reaction of the Ministry of Finance, Budget and National Planning on the development proved abortive.

The Promissory Notes Programme is targeted at easing the pressure on the federal government by local creditors, including contractors, exporters, settled judgment debts, state governments, and oil marketers.

The Minister of Works and Housing, Mr. Babatunde Fashola, had in December said contractors working for his ministry were being owed about N306 billion.

Earlier in October, his counterpart in the Ministry of Justice, Mr. Abubakar Malami, had said beneficiaries of N150 billion judgment debt owed by the federal government were mounting pressure on the ministry to pay.

Promissory notes are sovereign, negotiable instruments with liquid asset status but non-interest bearing.

They enable the federal government to formally recognize and account for its true liabilities in line with the International Public Sector Accounting Standards (IPSAS).