Jumia Technologies’ stock was among the hottest in the tech sector in 2020 and is likely to carry the momentum through 2021 and beyond. According to the research data seen by BizWatch Nigeria, analyzed and published by Sijoitusrahastot, its share price grew by more than 1,000% in 2020.

Shares of the German company started the year priced as low as $2.15 and its market value was a few hundred million. By the end of 2020, the price had risen to $59 and the market capitalization to $4.62 billion as a result of a growth explosion occasioned by the pandemic.

In December 2020 alone, the stock increased by 25.4%. Its year-to-date (YTD) growth as of January 29, 2021, was an impressive 47.18%.

Jumia seeks to be Africa’s answer to Amazon as it attempts to get within Africa the level of penetration that the FAANG giant has achieved. It provides eCommerce services in 11 countries on the continent.

According to an analysis carried out by Benzinga, 74% of the investors and traders who participated in the study think that Jumia’s share price will soar to $100 by the end of 2022.

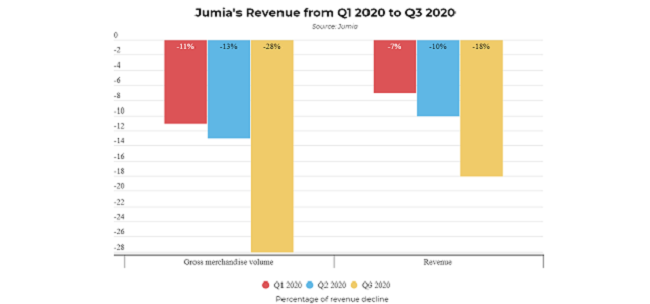

Jumia’s Revenue Sank by 12% YoY in Q1 to Q3 2020

Jumia, which went public in April 2020, believes that mobile internet penetration and economic expansion will drive its long-term growth in Africa. At the time it went public, the IMF had projected a GDP growth rate of 5.9% for Africa between 2018 and 2023. According to research firm Ovum, mobile internet penetration was expected to rise from 32% in 2017 to 73% by 2023

However, as a result of the pandemic, a number of Jumia’s key markets, including South Africa and Nigeria, went into a deep recession in 2020.

Based on a study by Fitch Ratings, South Africa’s economy was estimated to contract by 7.3% while Nigeria’s was forecast to fall by 3%. The two markets cumulatively account for more than 40% ($799 billion) of Jumia’s economic output across all markets. Though other markets such as Egypt, Kenya and Ghana had modest growth during the year, this would not offset the decline in key markets.

The impact of the economic downturn was seen on the eCommerce platform’s performance during the year. Its gross merchandise volume (GMV), which had contracted by 3% in the fiscal year 2019, sank by 11% in Q1 2020. In Q2 2020, the decline accelerated to 13% and reached 28% in Q3 2020.

READ ALSO: Top 5 Billionaires Richer Than 80 Poorest Countries Combined

The company’s revenue had grown by 24% in the fiscal year 2019, but declined by 7% in Q1 2020, 10% in Q2 and 18% in Q3 2020.

For the first nine months of 2020, it had a revenue slump of 12% YoY to €98 million ($119 million). Its operating loss during the period went from €167 million to €109 million. To a great extent, the decline was driven by a 47.2% drop in revenue from first-party sales. Jumia had wound up its first-party retail business in favor of a third-party marketplace for everyday products.

On the bright side, the number of active annual customers during the period soared by 23% to 6.7 million. The total number of orders shot up by 9% reaching 19.8 million. On Jumia Pay, the number of transactions increased by 34% YoY, boosting total payment volume by 74% to €137 million ($167 million).

At the end of Q3 2020, Jumia had €147 million ($178 million) cash at hand. In December 2020, it raised an additional $231 million from the sale of shares to US investors.

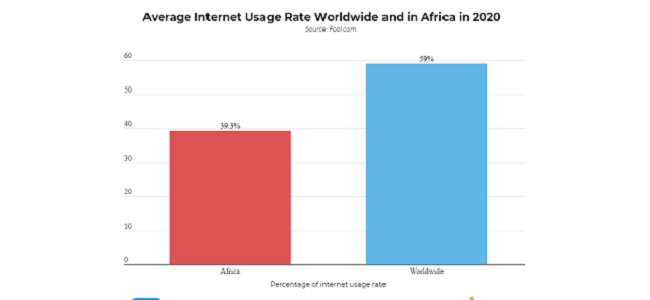

Africa’s Average Internet Usage Rate was 39.3% in 2020 vs. 59% Global Average

In all the countries where Jumia operates, the rate of eCommerce penetration is below 3% and this presents a significant opportunity for growth. However, realizing that growth is far from easy. Jumia requires relatively high rates of internet usage so as to get sufficient eCommerce consumption from its target audience.

On the African continent, the average internet usage rate stood at 39.3% in 2020. Comparatively, the average global internet usage rate is 59%. That makes it difficult for Jumia to make the most of the continent’s low eCommerce penetration.

Jumia Pay, its digital payment service, could assist the platform in accelerating the transition to being a basic-needs site. The fintech platform offers a digital wallet, an important service on a continent where two-thirds of the adult population is unbanked.

READ ALSO: Amazon To Pay Owed $61.7m Withheld Tips From Delivery Workers

Other eCommerce platforms in emerging markets such as MercadoLibre in Latin America have succeeded on a similar two-pronged approach. According to eMarketer, sales on MercadoLibre’s online marketplace surged an estimated 46.5% in 2020 to reach $20.51 billion.