Nigeria’s inflation rate increased to 24.08% in July 2023, the highest in years, due to a shortage of foreign exchange.

The July 2023 rate increased by 1.29% points from the previous month’s rate of 22.79%, according to the National Bureau of Statistics (NBS) in its Consumer Price Index (CPI) report released on Tuesday.

The CPI monitors the rate of change in the prices of goods and services.

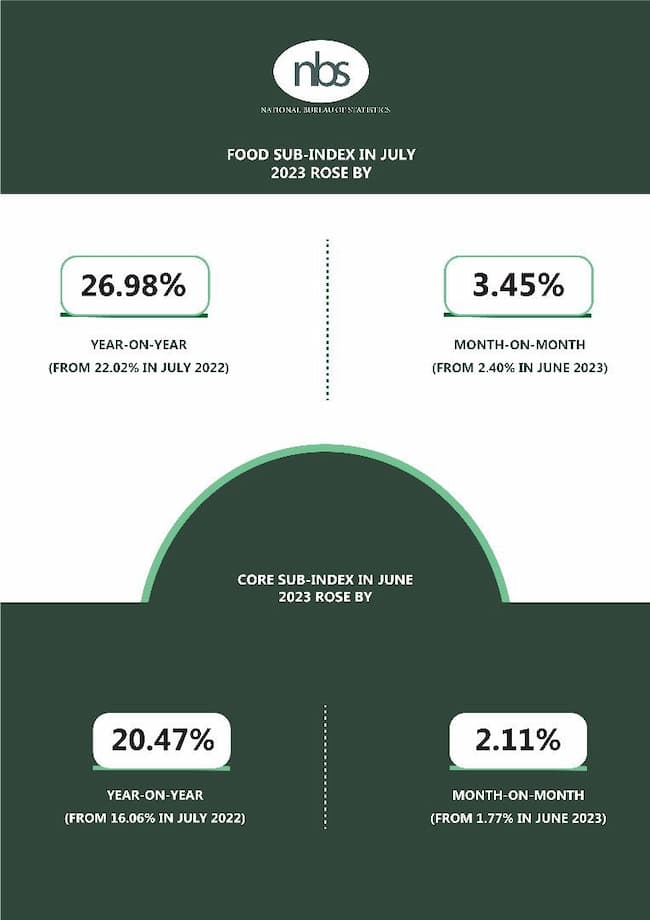

“Headline Inflation for July 2023 was 24.08% from 22.79% in June 2023. Food Inflation was 26.98% in July 2023 from 25.25% in June 2023. Urban Inflation was 25.83%, rural Inflation was 22.49%,” NBS said.

The NBS said, “In July 2023, the headline inflation rate rose to 24.08 per cent relative to June 2023 headline inflation rate which was 22.79 per cent.

“Looking at the movement, the July 2023 headline inflation rate showed an increase of 1.29 per cent points when compared to June 2023 headline inflation rate.

“On a year-on-year basis, the headline inflation rate was 4.44 per cent points higher compared to the rate recorded in July 2022, which was 19.64 per cent.

“This shows that the headline inflation rate (year-on-year basis) increased in July 2023 when compared to the same month in the preceding year (i.e., July 2022).”

BizWatch Nigeria recalls that on July 25, 2023, the Central Bank of Nigeria (CBN) raised the Monetary Policy Rate (MPR), which measures interest rates, from 18.5 percent to 18.75%.

The interest rate hike came amid rising food prices and growing transportation costs caused by the loss of a subsidy on Premium Motor Spirit (PMS), also known as petrol, with the price per litre rising from N184 to almost N600, a more than 200% increase.

According to the central bank, “raising interest rates has made a significant difference in moderating the rate of inflation.”

To address the country’s forex shortfall, with the dollar trading at more than N900 to the naira, Acting CBN Governor, Folashodun Shonubi, stated on Monday that the apex bank would take various steps in the coming days to enhance market liquidity.