Gold futures were in the red Wednesday, trading below $1,200 an ounce and set for their 11th loss in the past 12 sessions, ahead of a widely expected Federal Reserve interest-rate hike later in the day.

Gold for April delivery GCJ7, -0.29% fell $3.10, or 0.3%, to $1,199.50 an ounce. Gold futures had dug in just above the $1,200 mark in recent sessions, even as prices returned to late-January lows, and watching that line will remain a key trading driver.

The metal’s nine-session slide that ended Friday had marked the longest streak of declines since July 2015, FactSet data showed.

Prospects for higher rates have generally been dollar-positive and gold-negative as a richer buck makes gold less attractive to investors using another currency.

May silver SIK7, -0.37% slipped 2.3 cents, or 0.1%, to $16.90 an ounce.

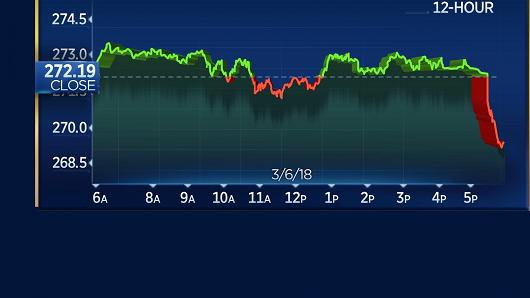

The Fed is widely expected to raise the range of its benchmark federal-funds rate by a quarter-point on Wednesday, which marks the end of its two-day policy meeting. The central bank will release its statement and new economic forecasts at 2 p.m. Eastern—after the gold futures settlement—followed by a news conference by Fed Chairwoman Janet Yellen.

Because markets have long priced in their expectations for this Fed move, “the increase itself may have limited market-moving potential, putting the spotlight on a revised set of economic and rate path projections as well as a press conference with Chair Yellen,” said Ilya Spivak, currency and commodities analyst with Daily FX.

Life success coach Tony Robbins tells you why the next crash is the best opportunity to jump-start your financial future.

Gold was little moved by a series of economic releases out Wednesday morning, which did little to alter expectations for the Fed meeting. The data revealed a still-strong reading in a New York-area business gauge, plus a small rise in a consumer-inflation reading and negligible February improvement in retail sales which were held back by delayed tax refunds.

Other metals saw mixed trading, with May copper HGK7, +0.78% up 3 cents, or 1.1%, at $2.665 a pound, April platinum PLJ7, -0.18% down $2.80, or 0.3%, at $936.10 an ounce and June palladium PAM7, +0.26% tacking on $2.25, or 0.3%, to $743.95 an ounce.

Among exchanged-traded funds, the SPDR Gold Trust GLD, +0.10% traded nearly unchanged, while the VanEck Vectors Gold Miners ETF GDX, +1.83% added 0.2%. The iShares Silver Trust SLV, -0.15% fell 0.3%.