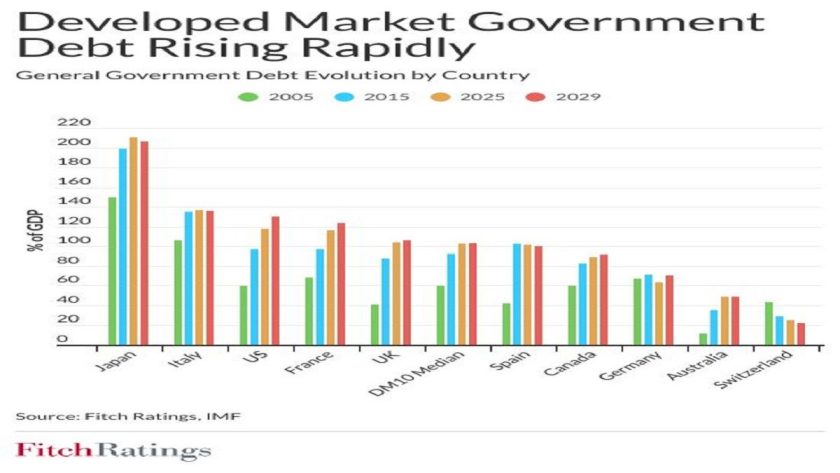

The collective government debt of the world’s ten most advanced economies is projected to climb past $64 trillion by the end of 2025, representing 115% of their combined GDP, according to the latest Developed Market Sovereigns Debt Sustainability Monitor published by Fitch Ratings.

This steep rise in sovereign liabilities marks a significant jump from the $25 trillion, or 72% of GDP, recorded in 2007. Fitch attributes over two-thirds of the debt expansion to the United States, which continues to be the driving force behind the surge.

Central to this development is the newly passed One Big Beautiful Bill Act, a sweeping fiscal policy that locks in sizeable budget deficits over the mid-term. The legislation not only extends major tax breaks first introduced in 2017 but also enhances deductions for state and local taxes and introduces new income tax exemptions. These revenue-losing measures are only partially offset by cuts to Medicaid and reductions in green energy subsidies.

Despite the legislative changes, Fitch does not expect a material change in its fiscal outlook for the U.S., maintaining its government deficit projections at 7.1% of GDP in 2025 and 7.8% in 2026.

Meanwhile, in Europe, new fiscal strains are emerging as NATO pushes its member states toward higher defense spending targets. Although this move may not independently trigger credit rating adjustments, Fitch warns it could amplify existing fiscal vulnerabilities, particularly in nations already grappling with high public debt and budget deficits.

The United Kingdom is also facing mounting fiscal pressures. A recent government decision to cancel previously announced welfare cuts has left limited room for budgetary flexibility. The reversal, which underscores the political challenges of fiscal consolidation, is expected to result in a UK budget deficit of 5.2% of GDP for 2025, according to Fitch.

“Government debt-to-GDP ratios are forecast to rise this year in Canada, France, Germany, Italy, the UK, and the US, while Australia, Japan, Spain, and Switzerland are expected to see a decline,” Fitch stated in its report.

The agency highlighted that a mix of sluggish economic growth, escalating interest rates, and increasing public spending will sustain pressure on debt sustainability across developed markets well beyond the near term.

As nations navigate the post-pandemic recovery and contend with geopolitical and economic uncertainties, Fitch warns that high debt levels are likely to remain a persistent structural challenge for advanced economies.