Have you wondered why the price of cooking gas has increased even though Nigeria is rich in oil and gas? Why has the electricity supply dropped?

Stears, a business publication released a statement and graphs to explain what is happening to Nigeria’s gas company, who is affected and why the electricity supply may have dropped.

Stears, in a series of, tweets said “Nigeria’s Liquified Natural Gas company (NLNG) has declared Force Majeure. So what does this mean for Nigerians? We have answers for you.

“By declaring force majeure, NLNG is saying that it cannot supply LNG to customers it has contracts with due to unforeseen circumstances (the flooding in Nigeria).

“But NLNG has been going through it since last year.

“Oil and gas companies like Shell supply natural gas to NLNG, which converts natural gas, a gas (duh), to a liquid called liquified natural gas (LNG) for export via ship to other countries.

“NLNG is jointly owned by the FG (through NNPC), Shell, Total and Eni.

“NLNG has always been one of Nigeria’s most successful companies, with $18 billion in dividends and $9 billion in taxes paid to the FG since its 1999 inception.

“Almost 60% of Nigeria’s gas supply is from associated gas which is found with oil. So, as vandalism and theft ravage Nigeria’s oil production, gas production is also affected.

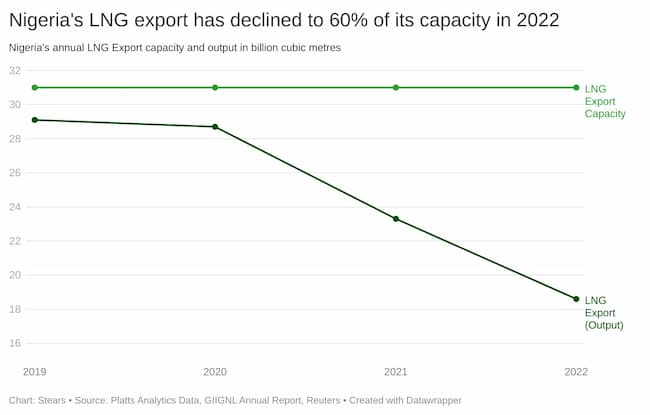

“Between 2020 and 2021, the company’s LNG export declined by almost 20%.

“Recent reports indicate that, before declaring force majeure, the company was operating at less than 60% capacity due to gas supply issues from oil and gas companies.

“This is down from 93% in 2020 and 75% in 2021. It’s the worst operational performance in the company’s history,” Stears said.

GRAPH

Stears also explained that “And now, due to high flood water levels, oil and gas companies that supply natural gas to NLNG have shut down production, meaning they’ve also declared Force Majeure. As a result, NLNG has been forced to shut down operations.

“The impact of this shutdown is far-reaching. First, NLNG can’t meet its supply obligations when LNG demand has peaked due to the Russia-Ukraine crisis.

“So, Nigeria is missing out on export revenue (dollars) when we need it most.

“NLNG’s customers are also affected. NLNG supplies 45% of Portugal’s LNG demand and is the country’s largest supplier.

“Even before the floods, Portugal’s energy minister raised concerns about NLNG’s capacity to supply the country with gas for winter. Portugal was already considering plans to diversify its LNG supply.

“For the government, lower output from NLNG means lower dividend and tax revenue even as our budget deficit soars.

“Last but not least, it also affects Nigerian citizens. NLNG supplies 40% of Nigeria’s LPG demand (cooking gas), while the rest is imported.

“As of August 2022, the average price of 12.5 KG of LPG was about ₦10,000, a 119% increase from ₦4,500 in August 2021.

“With a lower supply from NLNG, cooking gas prices could increase for Nigerians.

GRAPH

“Finally, oil and gas companies also supply natural gas to electricity generation companies.

“A lower gas supply will mean lower available generation capacity, fewer electricity hours, and more frequent grid collapses than Nigerians already deal with.”