The Federal Government has introduced the Ministry of Finance Incorporated Real Estate Investment Fund, a new initiative designed to address Nigeria’s housing shortage. By collaborating with the pension and financial sectors, the fund aims to provide affordable housing options to Nigerians.

This development is a cornerstone of the One Million Homes Presidential Initiative, which seeks to offer low-cost mortgage financing to eligible citizens.

The Ministry of Finance has announced that the MREIF will transform the housing sector by increasing the number of Nigerians with access to affordable homes. This initiative is in line with the government’s goal of making homeownership more attainable, particularly for pension account holders.

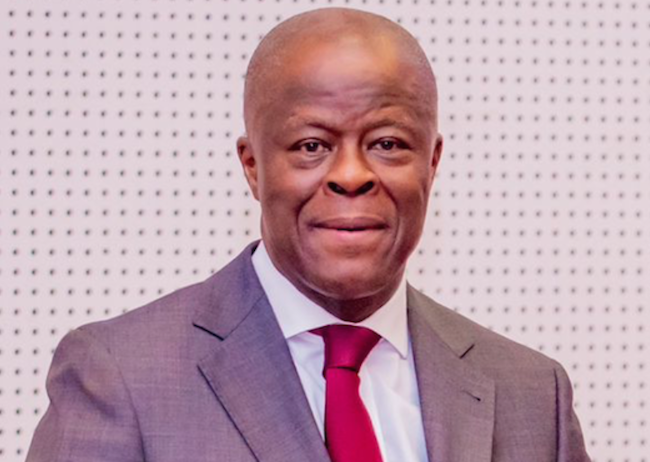

It was revealed that a high-level meeting was held to discuss the launch of the MREIF. At the meeting, the Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun, emphasised the transformative potential of the fund.

He noted that the MREIF would provide cost-effective mortgage solutions, particularly benefiting pension account holders, and would serve as a critical component in addressing the country’s housing challenges.

“The launch of this fund represents a major stride in delivering affordable homes to Nigerians. With the support of the pension and financial sectors, we are confident that this initiative will transform the housing landscape and create significant opportunities for homeowners,” Edun said.

The MREIF will operate under a market-driven framework to ensure compliance with regulatory standards while promoting broad accessibility to homeownership.

The CEO of the Ministry of Finance Incorporated, Dr Armstrong Takang, highlighted the importance of transparency and market efficiency in managing the fund.

Takang stated, “The MREIF is designed not only to boost housing access but also to strengthen the mortgage market, creating a viable and sustainable pathway for homeownership across Nigeria.”

The Federal Government has assembled a team of industry leaders from the pension and financial sectors to ensure the success of the MREIF.

Prominent figures include Dr. Oluwatoyin Maiden, Accountant General of the Federation; Wale Odutola, Chief Executive Officer of ARM Pensions; Funmi Ekundayo, CEO of STC Trustees; and Sani Yakubu, co-coordinator of the MREIF.

Additional key stakeholders include Temitayo Ajayi of Vetiva Advisory, Saadu Jijji, Managing Director of PAL Pensions, Tony Odutola, Deputy Chief Investment Officer at FCMB Pensions LTD, and Nuhu Modibbo, Executive Director of Access Pensions.”

The experts involved in the MREIF possess extensive experience in pension fund management, real estate financing, and investment advisory. Their expertise will be invaluable in shaping the fund’s structure and deployment.

Their contributions will be crucial in ensuring that the MREIF achieves its goal of making affordable homeownership a reality for many Nigerians.

The government, through this developing approach, intends to eliminate the barriers that have long prevented many Nigerians from owning their homes.

The MREIF presents a unique opportunity for pension account holders to secure mortgage loans at lower interest rates, offering a sustainable solution to Nigeria’s housing crisis.

This article was written by Tamaraebiju Jide, a student at Elizade University