The dollar index traded lower today after the US President criticized the Federal Reserve for the ongoing interest rate hikes. Already, the Fed hiked two times and is expected to do two more hikes this year. The president’s complaint is that the rate hikes will negatively influence the current economic growth.

His other concern is that the US is the only country implementing interest rates hikes. Other central banks like the ECB, BOJ, and BOE have all indicated that they might leave rates low for some time. In addition, the People’s Bank of China (PBOC) has started bringing rates down to boost the country’s exports in what is now turning out to be a currency war.

Global stocks fell Monday after a fiery tweet by the US President increased risks. The US President sent a tweet to the Iranian president, Hassan Rouhani, warning him about threatening the United States. This tweet came after Rouhani threatened the US against imposing tariffs on its industries.

The country has also threatened to shut down the travel route of gulf states crude oil to other markets if the US carries out the sanctions. In response, crude oil prices rose while stocks fell. The S&P and Nasdaq futures point to a lower open while the DAX and CAC were lower by 20 and 25 basis points respectively. On the other hand, Chinese stocks rose after the government injected $74 billion into the banking system.

The euro jumped against its closest peers as the European Commission President, Jean Claude Juncker arrives to the United States for talks with the Trump administration. The meeting is highly anticipated by traders, investors, and policymakers who hope for a breakthrough.

In recent weeks, Donald Trump has attacked the EU as being foes to the US. He has also promised to put tariffs on the EU vehicles, which would have a major implication for the EU economy. Earlier today, a spokesperson for Juncker said that he would not bring any offer to the US as Larry Kudlow had requested. The EU has also prepared retaliatory tariffs if the US goes on with the auto tariffs.

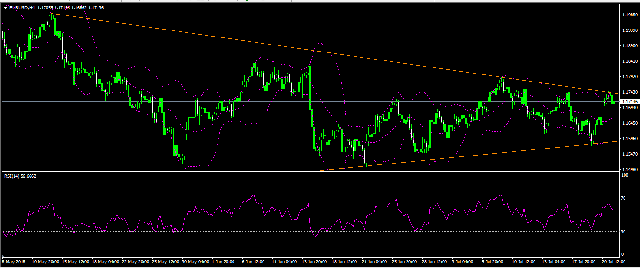

The EUR/USD rose to an intraday high of 1.1750, which is also an important resistance level as shown below. The pair rose because of the dollar weakness and the optimism of a breakthrough between the US and EU on trade. The current price is slightly lower than the upper Bollinger Band, while the RSI is currently at 56. The pair could drop to test the middle band at 1.1660.

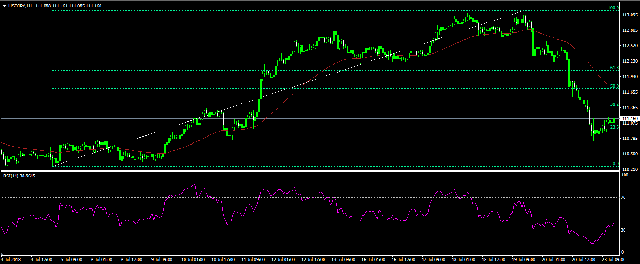

USD/JPY

The USD/JPY dropped sharply mostly because of the stronger dollar. The pair is now trading at 111.14, which is slightly higher than the intraday low of 110.74. This price is near the 23.6% Fibonacci Retracement level. The RSI has moved from the intraday low of 12.5 and is currently at 40. This means that there are chances that the pair could recover the losses and possibly test the important 111.70 level, which is also the 50% Fibonacci Retracement level.

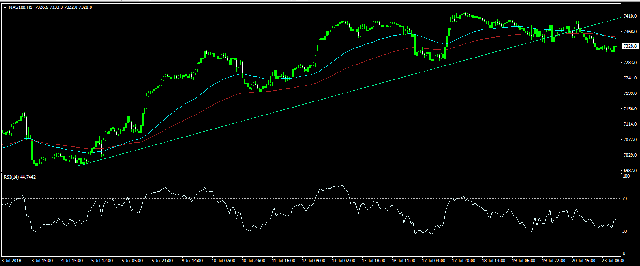

NAS100

The Nasdaq 100 index is trading lower mostly because of Tesla, which is down by almost 4% in the pre-market open. The Wall Street Journal reported that the company had requested for money from its suppliers for goods delivered since 2016. Traders are also eying key earnings releases this week from Facebook and Alphabet. The NAS100 is now trading at $7330, which is lower than the 50 and 100-day exponential moving average. It is also below an important support line as shown below. The RSI is currently at 51. The pair could move up to trade above the EMAs and to test the important $7,400 line.