The dollar recovered against its rivals on Thursday as caution before a G20 meeting prompted investors to buy back the currency after comments by the Federal Reserve chief were seen as a sign that a rising trend in U.S. rates may be coming to a close.

The G20 summit on Friday and Saturday is shaping up as a key event for markets given that U.S. President Donald Trump and Chinese President Xi Jinping are scheduled to discuss contentious trade matters after months of tensions between the world’s two biggest economies.

Against this backdrop, risk appetite was likely to remain subdued and benefit the safe-haven dollar, analysts said.

“If we were to see a significant improvement in the outlook for trade wars over the weekend, that combined with a more dovish Fed would boost risk appetite and we could see a flow back out of dollars into risk assets,” said Jane Foley, a senior currency strategist at Rabobank.

“It’s our base view that trade wars will continue for some time. On that assumption, risk appetite remains under pressure and the dollar remains on a firm footing.”

The dollar index, which measures the value of the greenback against a basket of other major currencies, firmed to 97, up almost 0.4 percent from almost one-week lows hit earlier.

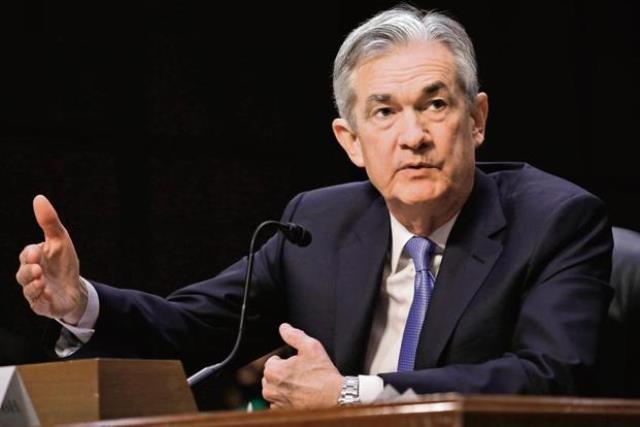

The greenback took a beating after Fed chief Jerome Powell said on Wednesday that U.S. interest rates were just below neutral — a comment interpreted by markets to signal that a pause in the three-year long rate-hiking cycle may be near.

But dollar weakness abated as the European session wore on. Traders put that down to caution ahead of the G20 meeting and also a sense that even if the Fed pauses rate hikes – the gap between U.S. interest rates and their peers is likely to remain large, bolstering the greenback.

“At the end of the day it (the U.S. dollar) still has a sizeable interest rate advantage,” said David Kohl, chief currency strategist at Julius Bar.

Data on Thursday showed the Swiss economy unexpectedly contracted in the third quarter, while Sweden’s gross domestic product shrank for the first time in five years – highlighting that interest rates in the major economies apart from the United States are likely to remain low for some time.

And while expectations of Fed rate increases have declined to around 47 basis points over the next year from 52 basis points earlier this week, market expectations for a rise in euro zone rates have also fallen on weak data.

Money markets price in just over a 70 percent chance of a rate rise from the European Central Bank by the end of 2019, down from 100 percent earlier this month.

The euro fetched $1.1351 and was 0.1 percent lower on the day, having touched $1.1398 – its highest in almost a week. The dollar was down 0.25 percent at 113.41 yen, but off the day’s lows of 113.21.

COMING UP:

Focus turned to the release this session of the October U.S PCE price index, the Fed’s favoured inflation gauge, for more clues on the outlook for U.S. interest rates. Minutes from the Fed’s November meeting are also released later in the day.

With trade wars back in focus ahead of the G20 meeting, the dollar, was expected to hold its ground.

The threat of an escalating trade conflict between the world’s two biggest economies is a major source of concern for next year, amid expectations that the world economy could slow.

Those concerns have boosted demand for the dollar but weakened the Chinese yuan. Derivative markets such as risk reversals in the Chinese currency predict more weakness.

“There is some dust settling on the dollar after the Powell comments and dollar/yuan can easily go above 7 per dollar if the U.S. decides to carry ahead its tariff threat at the G20,” said Kenneth Broux, a currency strategist at Societe Generale in London.

Elsewhere, the pound tumbled about 0.4 percent against both the euro and dollar on concern about the UK parliament’s vote on Brexit and after the Bank of England warned of risks to the currency if Britain leaves the European Union in a disorderedly manner.