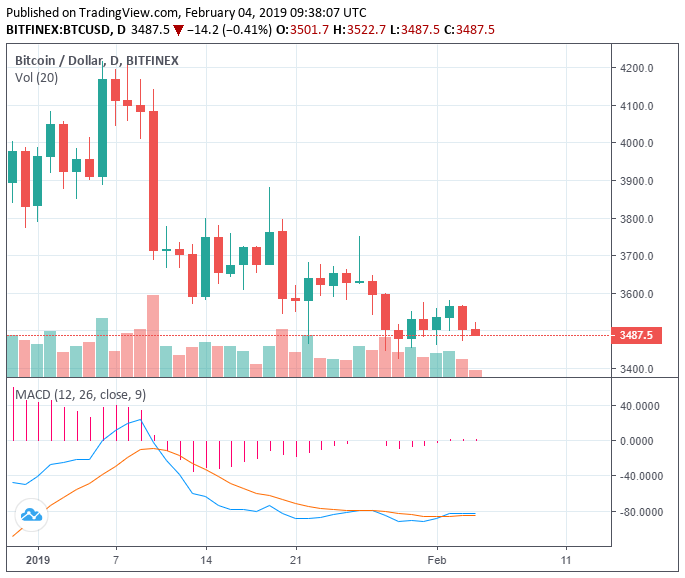

In the last 24 hours, the crypto market has rebounded slightly by $1 billion as the Bitcoin price recovered to mid-$3,500.

Last week, several traders said that maintaining momentum above the $3,500 mark is crucial for preventing a drop to the low $3,000 region and possibly to $2,000.

WHAT’S BEARISH IN THE BITCOIN MARKET?

According to cryptocurrency analyst Murad Mahmudov, the engagement of the keyword “Bitcoin” on Twitter has declined substantially in the past 14 months.

Twitter remains as the most widely utilized platform for cryptocurrency researchers, developers, and businesses.

The drop in the engagement on the platform demonstrates a lack of interest in the sector even from individuals and businesses that have been in the industry for a long period.

“This screams bearish. Tweets about Bitcoin at the same level as 2014 and lower than at any point in 2016, like nothing has changed. That is an absolute disaster for the price in the medium-term in my opinion,” Mahmudov said.

In the short-term, as investors in the cryptocurrency sector discover that the bear market will last longer than expected, an increasing number of holders may begin to sell.

Already, as CCN reported, the current bear market is the longest bear market to date in the history of the cryptocurrency sector.

Only when speculation dries out and the true believers of the asset class remain in the ecosystem will a proper bottom be established, the analyst explained.

Mahmudov said:

You need a complete price exhaustion and attention exhaustion from anyone except the absolute true believers. More people will sell when they realize that this winter will last for even longer than they thought, or that they can potentially buy back in later & lower.

Although some traders expect the Bitcoin price to recover beyond the $4,000 resistance level in the days to come, generally, the sentiment remains negative.

https://twitter.com/TheCryptoDog/status/1091845184831307776

The bear market, which entrepreneurs like Ledger CEO Eric Larchevêque said could transform into nuclear winter that lasts two years, is still in full force.

In the long run, Mahmudov said that investors will be rewarded for building and learning in a gloomy period, as were investors subsequent to the Dot Com era.

However, in the foreseeable future, the analyst said that investors have to acknowledge the overall weakness in BTC and consider it a high-risk asset.

“Add to all this the overall weakness in the global macroeconomy & bitcoin still being perceived as a risk asset. This bear market will last for much longer. Those that are building, learning, studying right now, of course, will be handsomely rewarded in 2023/24,” Mahmudov added.

Investors like Ari Paul are hopeful that institutional investors may enter the cryptocurrency market by the latter half of 2019, with the infrastructure surrounding the asset class strengthening.

The inflow of capital from institutions could assist BTC in initiating a recovery.

TRADERS OPTIMISTIC IN SHORT-TERM

Bitcoin and Ethereum have recovered relatively well from the low $3,000 region and $100 mark respectively.

Possibly due to the presence of large buy walls on fiat-to-crypto exchanges, BTC rebounded strongly from the $3,300 support level.

Longed some ETH at $105.3 and some BTC at $3394.

Tight stop loss – we should be going up soon if I'm right.— DonAlt (@CryptoDonAlt) February 3, 2019

It remains to be seen whether BTC can sustain its stability at $3,500. If it does, traders expect the dominant cryptocurrency to eye a move toward $4,000.

Previously, DonAlt said that the inability of BTC to remain above $3,500 could lead it below the $3,000 mark.

“Closed below support, not looking too pretty. BTC needs to reclaim supports quickly otherwise. I expect it to go for the previous lows. If those don’t hold I’m looking at $2,900. There are no supports left on the daily, hope for a fakeout or SFP at the lows,” the trader said.

As BTC stays in a sideways market, a handful of tokens and digital assets may perform well against both BTC and USD.

TRON, which has outperformed BTC throughout the past month, recorded yet another 4 percent gain on the day.