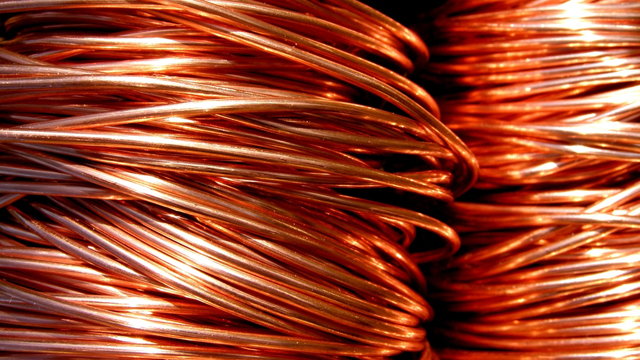

Metals, copper and zinc prices eased on Tuesday, October 3, after starting the week firmer, with investors taking profits in holiday-thinned trading in Asia.

Commodities traders said the week-long absence of trading on the Shanghai Futures Exchange due to China’s National Day break could drag on less actively traded London Metal Exchange contracts in Asian time zones.

“We saw some profit-taking early on in copper and zinc, which had a strong run on Monday (when zinc hit its highest price in more than 10 years),” said a Perth-based trader.

* COPPER SLIPS: Three-month copper on the London Metal Exchange had declined 0.4 percent to $6,465 a tonne by 0530 GMT, more than reversing a modest overnight gain.

* ZINC CONTRACTION: LME three-month zinc eased by 0.4 percent to $3,223.25 a tonne. Zinc was the top performer on the LME on Monday, touching its strongest since August 2007 at $3,248 a tonne.

The Indonesian unit of U.S. miner Freeport McMoRan Inc can continue to export copper concentrate even if negotiations over the company’s permit to operate the giant Grasberg mine are not resolved this month, a mining ministry official said.

Available LME zinc inventories MZNSTX-TOTAL fell by 16,950 tonnes on Monday, bringing the decline so far this year to 64 percent. One party controlled 50-80 percent of those stocks <0#LME-WHL>, LME data showed.

LME nickel turned around overnight losses to trade 1 percent higher at $10,490 a tonne, while aluminium and lead were little changed at $2,108 and $2,519 a tonne, respectively.