Nigeria’s ambition to evolve into a $1 trillion economy hinges significantly on the strength of its capital market, according to the Minister of Finance, Mr. Wale Edun. Speaking through the Minister of State for Finance, Dr. Doris Uzoka-Anite, at the Capital Market Committee (CMC) gathering, Edun reiterated that substantial progress has been made in transforming the market since 2015.

He cited advances in governance frameworks, the rollout of innovative financial products and trading platforms, tighter regulatory oversight, and heightened investor engagement as evidence that the capital market is poised to support Nigeria’s economic aspirations.

The minister noted that the Capital Market Master Plan (2015-2025) has been pivotal in expanding the market’s role in the broader economy. The master plan, now revised, places a strong emphasis on digitization, innovation, sustainability, inclusiveness, and robust capital formation, aligning seamlessly with the country’s overarching economic reform efforts.

According to Edun, the recently passed Investment and Securities Act (ISA) modernizes the market’s legal and regulatory foundation. It simplifies enforcement protocols and addresses emerging financial innovations such as digital assets and crowdfunding.

He acknowledged that while the Act presents both challenges and opportunities, it ultimately fosters wider market engagement. Edun stressed that the government remains committed to nurturing an enabling landscape where private-sector innovation can thrive under a transparent and equitable system.

He emphasized the capital market’s role not just in raising capital but also in driving wealth distribution, inclusive economic growth, and long-term national stability.

Highlighting the economy’s performance, Edun pointed out that regulatory reforms by the Securities and Exchange Commission (SEC)—including its recent alignment with global standards through the GBMC Network of IOSCO and its adoption of ISSB sustainability standards—contributed to the country recording its fastest GDP growth in nearly ten years, spurred by a buoyant fourth quarter in 2024.

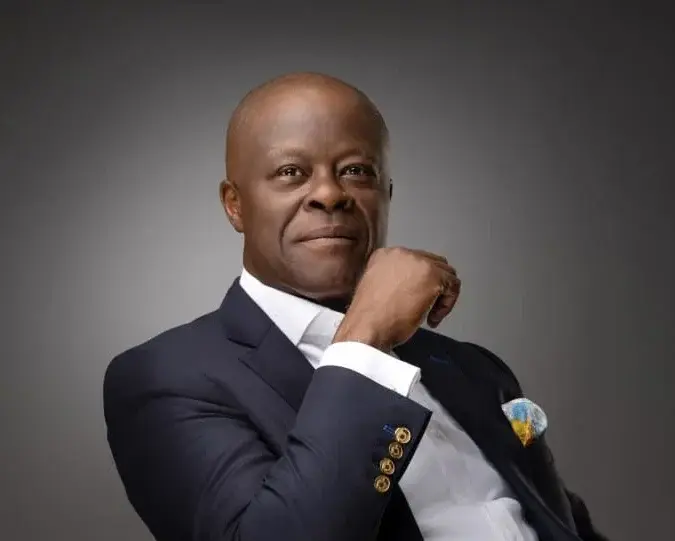

In his remarks, SEC Director-General Dr. Emomotimi Agama reaffirmed the commission’s commitment to overhauling market regulations and fostering market development.

He described the passage of the ISA 2025 as a landmark shift that would usher in a transformative era for the nation’s capital market. Agama underscored the commission’s efforts to engage stakeholders proactively, spread awareness of the new law, and encourage both innovation and compliance.

Dr. Agama further emphasized restoring investor trust, resolving complaints efficiently, and ensuring that Nigerians across all strata participate in wealth creation. He stated that the commission has assembled a dedicated team to manage ISA 2025’s implementation and another to conduct nationwide sensitization.

To expand access, the commission launched a podcast series designed to demystify ISA 2025 and make its provisions accessible to everyday Nigerians.

Reflecting on 2024, Agama lauded the market’s strong performance, with the NGX All-Share Index up by 37.65% and market capitalization growing by 53.39%. He also highlighted SEC’s strides in enhancing regulatory agility, upholding market transparency, and promoting investor protection.

He reiterated the Commission’s dedication to financial inclusion and investor education, noting ongoing programs to empower women, youth, and underserved communities. Technology remains a central theme, with the commission deploying an e-survey to gauge the adoption of emerging technologies in the Nigerian capital market.

Agama closed by reaffirming SEC’s mission to build a vibrant, transparent, and sustainable capital market. A major highlight of the CMC meeting was the official unveiling of the ISA 2025 by the Minister of State.